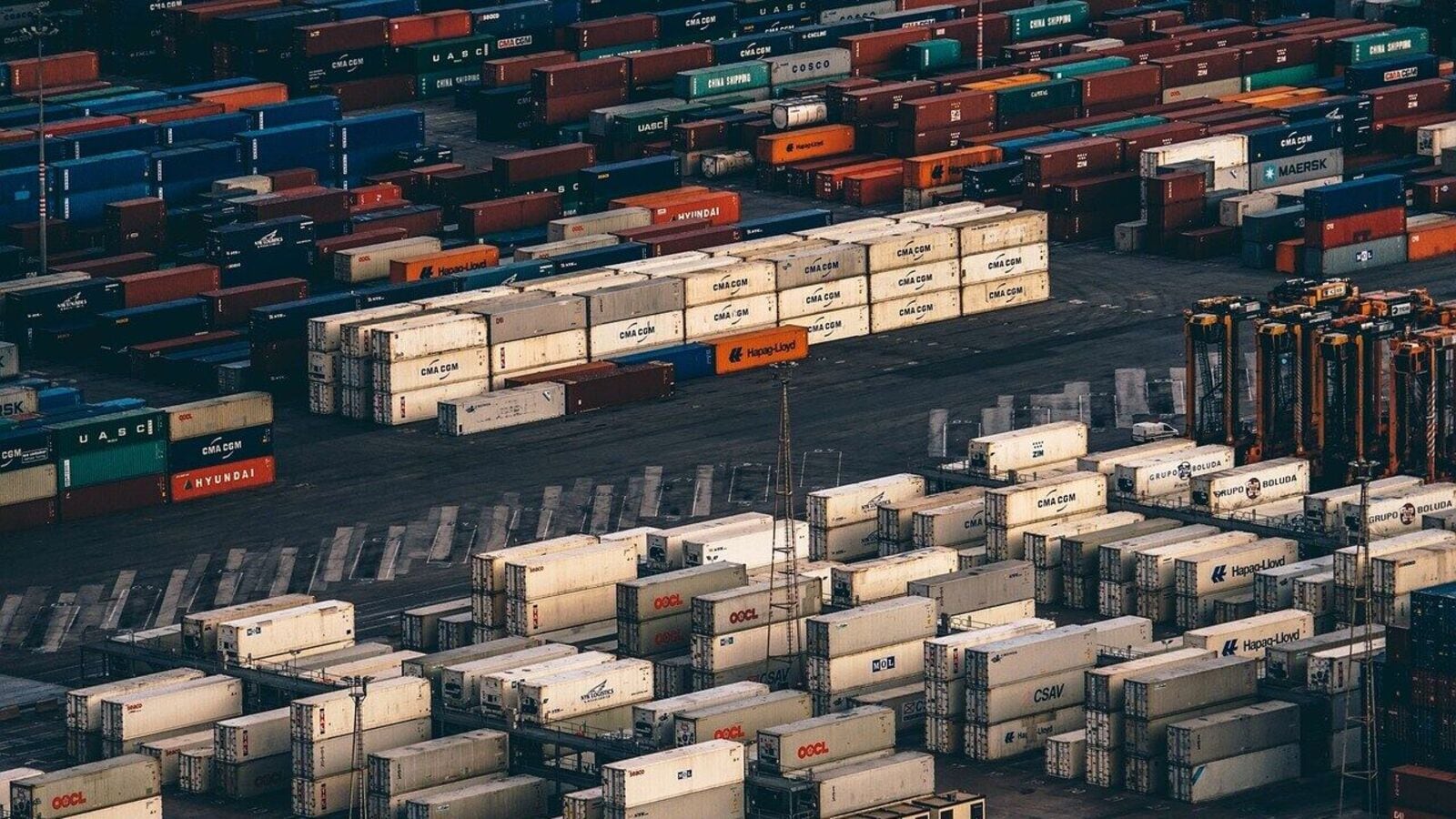

In recent years, India has seen significant advancements in its maritime sector, with the Jawaharlal Nehru Port Authority (JNPA) leading initiatives to enhance port capacities from 6.6 million to 10 million TEUs. Minister Sonowal emphasized strategic projects like the Vadhvan Port development and the prominent Galathea Bay designation, which play vital roles in augmenting India’s maritime infrastructure and supporting economic growth.

The Indian government is further investing in shipbuilding and repair clusters across various states, including Maharashtra, Kerala, Andhra Pradesh, Odisha, and Gujarat. Notably, 3,900 acres have been earmarked in Kandla and VOC Port for hydrogen manufacturing hubs, reinforcing India’s commitment to becoming a frontrunner in clean energy innovations.

With major ports observing a remarkable 4.87% increase in traffic in 2024, India’s maritime industry is poised for significant growth, setting the stage for expansive economic opportunities and job creation.

Key Players in India’s Maritime Growth

With the prediction of container capacity doubling, several companies stand out as prime candidates for potential investment and attention:

Container Corporation of India (Concor)

Container Corporation of India (Concor) holds the title of the largest railway logistics company in the nation, boasting a staggering 75% market share in containerized rail transport. This dominance can be traced back to its first-mover advantage established before 2006, allowing Concor to create an extensive and efficient logistics network unmatched by competitors.

Between 2020 and 2024, Concor enjoyed a compound annual growth rate (CAGR) of 4.4% in sales, with net profit growth at 0.6%. The company’s consistent financial strength is reflected in a five-year average Return on Equity (RoE) of 8% and Return on Capital Employed (RoCE) of 11%. Significant operational upgrades include the addition of high-speed rakes, increasing the fleet to 378 rakes, and expanding container capacity with 2,500 new containers, bringing the total to 47,000.

With a ₹1.5 billion capital expenditure already spent from a ₹6.1 billion budget for the fiscal year, Concor is also leading the charge in eco-friendly logistics with its fleet of 100 LNG trucks and plans to double that number. The company’s growth strategy centers on expanding bulk cement and tank container services, developing partnerships with shipping lines, and enhancing direct port delivery (DPD) solutions.

Garden Reach Shipbuilders & Engineers (GRSE)

Garden Reach Shipbuilders & Engineers Ltd (GRSE), a significant player in the shipbuilding sector under the Ministry of Defence, focuses on constructing vessels for the Indian Navy and Coast Guard. The company is at the forefront of innovation, collaborating strategically with Medha Servo Drives to develop advanced electrical systems for both naval and commercial vessels, enhancing India’s capabilities in cutting-edge shipbuilding.

GRSE’s robust growth is demonstrated through a recent ₹8.4 billion contract to build an ocean research vessel and a $54 million deal for constructing four multi-purpose vessels for a German company. The company’s order book stood at an impressive ₹252.31 billion as of June 30, reflecting strong financial performance with sales and net profit CAGR of 20.4% and 26.6%, respectively.

Gateway Distriparks

Gateway Distriparks is a comprehensive inter-modal logistics provider focused on warehousing, transportation, and container handling. As the demand for logistics solutions increases alongside the expected doubling of container capacity, Gateway is strategically positioned to benefit, particularly in its rail services.

The company reported 7.2% revenue growth in FY24, despite some challenges due to global market conditions impacting rail throughput. Over the past four years, Gateway Distriparks achieved a sales CAGR of 12% and a net profit CAGR of 15.9%. With steady returns, the company is keen on expanding its Inland Container Depots (ICDs) and building new terminals, although progress has faced location acquisition challenges.

JSW Infrastructure

JSW Infrastructure provides a wide array of maritime services, including cargo handling, storage solutions, and logistical support. With a CAGR of 27.8% in sales and 33.6% in net profit from 2020 to 2024, the company is on a growth trajectory to enhance its cargo handling capacity to 400 million tons by FY30, focusing on both new and existing port projects.

The strategic acquisition of a majority stake in Navkar Corp. for ₹16.4 billion boosts its logistics network, enhancing its regional market strengths. With a solid balance sheet and a net cash position of ₹1.9 billion, JSW Infrastructure is strategically aligned to capitalize on emerging opportunities in the logistical landscape of India.

Jupiter Wagons

As a comprehensive railway engineering firm, Jupiter Wagons specializes in manufacturing freight wagons and components for passenger coaches, facilitating the growing railway infrastructure within India. The company is on the verge of diversifying its product line to include battery-operated light commercial vehicles under its JEM TEZ brand.

Demonstrating robust growth, Jupiter Wagons has recorded an impressive surge in revenue and net profit—3.7 times and 6.2 times respectively—between 2021 and 2024. As of March 31, 2024, the company’s order book stood at ₹71 billion, signifying strong demand ahead. With plans to focus on specialized wagons catering to various industries, including steel and cement, the company is well-positioned to enhance logistics efficiency in India.

Conclusion

The impending doubling of container handling capacity presents immense growth potential for these five key players within India’s maritime sector. Their strategic initiatives and strong market positions make them ideally suited to leverage this growth opportunity.

Nonetheless, investors should remain diligent, continuously evaluating each company’s performance and strategies within this dynamic landscape. By staying informed and proactive, they can capitalize on the burgeoning opportunities while effectively managing associated risks in this transformative industry.

Disclaimer: This article is for informational purposes only and should not be considered as a stock recommendation.