In a landscape marked by escalating tensions, India has strategically positioned three naval warships in Iran as part of an extensive training initiative in the Persian Gulf. This action highlights the intricate nature of India’s diplomatic relations, as it seeks to maintain a delicate balance between Israel and Iran—two nations of critical strategic importance. While India firmly stands alongside Israel in its battle against terrorism, its enduring energy and defense ties with Iran cannot be overlooked.

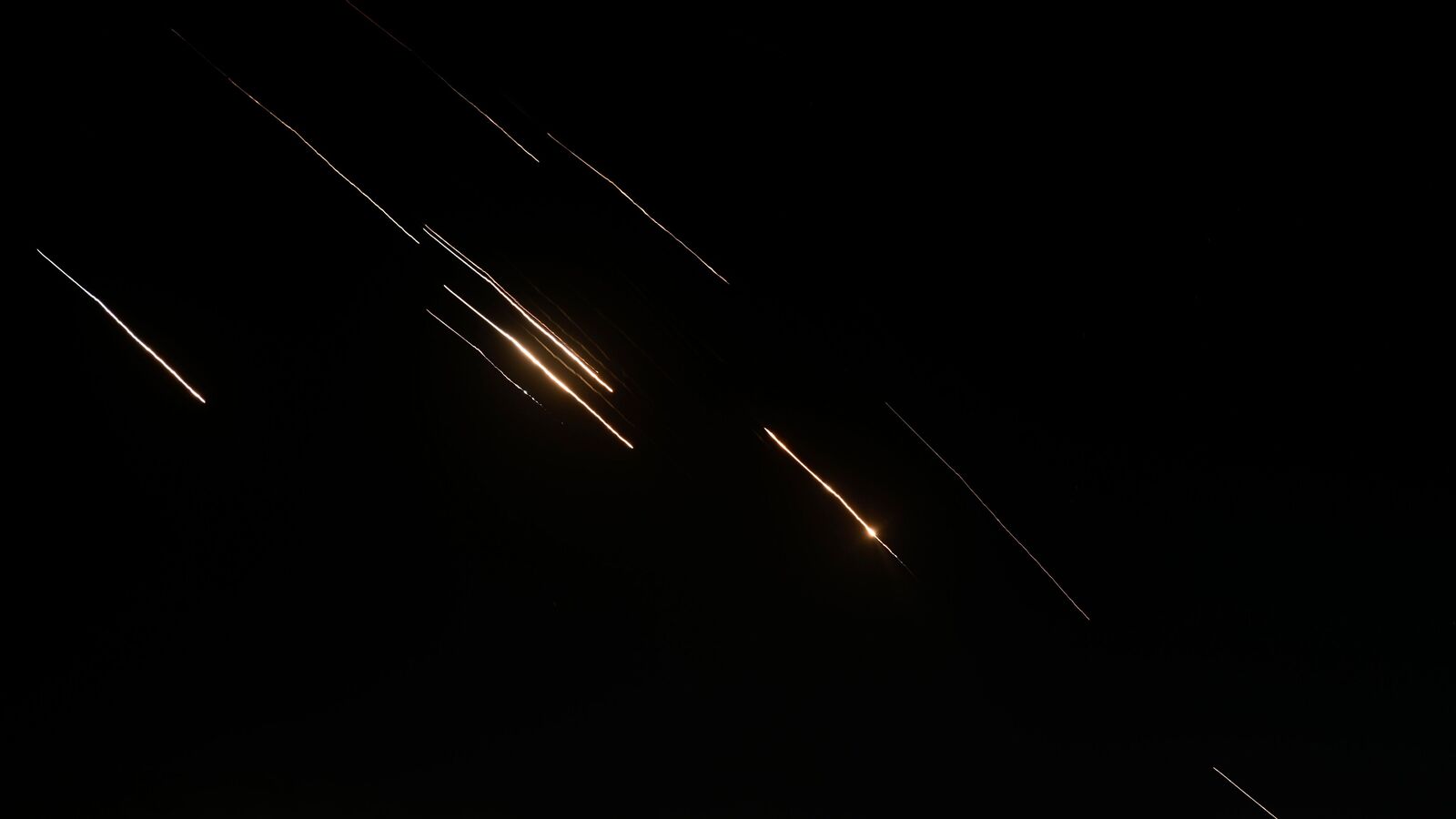

The ripple effects of these geopolitical dynamics have reverberated through the Indian stock market. Last month, as hostilities escalated between Israel and Iran, culminating in the launch of over 180 missiles, market sentiment declined sharply, triggering a nearly 6% downturn in the BSE Sensex over a span of six days.

In the midst of this unrest, investors looking for opportunities may find potential in at least 14 Indian companies with a footprint in Israel, which come with both risks and rewards. Among them, the defense sector has consistently shown resilience during turbulent times. In this article, we delve into the top defense companies well-positioned to capitalize on the ongoing Israel-Iran conflict.

#1 Premier Explosives

Premier Explosives caters to various sectors including mining, infrastructure, defense, and aerospace. The company is significantly positioned to gain from the increasing demands for explosives tied to the current geopolitical climate. Its strong alignment with the Indian government’s rising defense budget further bolsters its prospects.

Notably, Premier is unique as the sole Indian firm qualified for countermeasures, specializing in the export of fully assembled rocket motors. Expanding its portfolio to include warheads, the company has made strides in the international market, supplying products to nations such as Israel, Greece, Jordan, Türkiye, Nepal, Thailand, the Philippines, Indonesia, and Djibouti.

Recent reports indicate that Premier Explosives manufactures solid propellants for Barak missiles, likely applicable in the ongoing conflict, with confirmed ongoing exports to Israel. With a remarkable order book totaling ₹8.9 billion, of which ₹7.6 billion derives from defense contracts, Premier is poised for substantial growth. The first quarter of FY25 showcased a revenue increase from ₹620 million to ₹830 million compared to last year, even as operating profit experienced a slight decrease.

Looking forward, Premier is on track to secure further contracts from the Ministry of Defence and Israel while diversifying into mine and ammunition manufacturing under the Atmanirbhar Bharat initiative. Plans are in place for an ₹8.6 billion phased capital expenditure program focused on establishing defense explosives and ammunition plants in Rayagada District.

#2 Solar Industries

Solar Industries stands as one of India’s largest manufacturers of bulk and cartridge explosives, detonators, and associated components vital for mining, infrastructure, and construction. The company’s offerings also encompass high-energy explosives and defense-specific products, such as ammunition filling and pyros fuses.

The defense segment is anticipated to see significant growth, fueled by expected orders for the Pinaka rocket system and other crucial contracts. Additionally, Solar Industries aims to penetrate new markets, with Kazakhstan and Thailand on their radar for expansion.

In March 2024, the company secured export orders worth ₹4.5 billion for defense-related products over the next two years, resulting in an impressive order book estimated at ₹36.5 billion, with around ₹23 billion linked to defense contracts, both for domestic and export purposes.

The first quarter of FY25 was particularly noteworthy, with the company achieving its highest-ever quarterly EBITDA and net profit of ₹4.7 billion and ₹3 billion, respectively, alongside a 16% increase in domestic explosives volume. As the Indian government ramps up FY25 budget allocations for infrastructure, housing, and roads—in tandem with heightened demand stemming from the Israel-Iran conflict—the outlook for Solar Industries remains robust, generating annual cash accruals of ₹9-10 billion against capital expenditures of ₹8 billion.

#3 Data Patterns (India) Ltd.

Data Patterns (India) is rapidly establishing itself as a premier player in the defense and aerospace electronics arena. The company distinguishes itself by being one of the few vertically integrated firms offering indigenous solutions within India.

Positioned favorably to exploit the Indian government’s recent import bans on 780 defense items, Data Patterns is presented with substantial opportunities to bridge critical supply gaps. Recently, the company secured a project through the Defence Research & Development Organisation (DRDO) under the Technology Development Fund scheme, focusing on radar signal processing with an active antenna array simulator.

In FY24, Data Patterns reported total revenues of ₹5.6 billion, a commendable increase from ₹4.6 billion the previous year, spurred by heightened order inflow and effective execution. Notably, its radar and electronic warfare segment alone contributed ₹3.1 billion to this total. With a strong order book of ₹11.4 billion, the company looks to capitalize on several opportunities, including flight control radars, expanded UAV radar systems, and cutting-edge electronic warfare solutions.

#4 Hindustan Aeronautics Ltd (HAL)

Hindustan Aeronautics Ltd (HAL) plays a pivotal role in India’s aerospace and defense landscape through its focus on designing, developing, manufacturing, and maintaining aircraft, helicopters, engines, and associated components. The company has witnessed significant momentum in line with Prime Minister Narendra Modi’s Atmanirbhar Bharat initiative, securing numerous defense contracts as part of India’s firm commitment to self-reliance.

As of FY24, HAL’s order book reached ₹940 billion—an increase from ₹820 billion in FY22—with further major orders anticipated in FY25. Significant among these is a ₹260 billion contract for 240 aero engines intended for the Su-30 MKI aircraft, propelling the total order value to ₹1,200 billion, with deliveries set to commence in FY26.

In FY24, HAL’s capital expenditure totaled ₹21.6 billion, primarily supporting its Green Field Helicopter project in Tumakuru. The company is committed to an average ₹30 billion annual investment through FY30 to facilitate growth and expansion. Over the next three years, HAL projects to secure contracts worth ₹1,600 to ₹1,700 billion.

Conclusion

The defense sector presents significant growth opportunities, yet investors should carefully weigh various factors before committing to investments. Although India currently exports defense equipment to 42 nations, its exports are heavily reliant on just a few markets—Myanmar (46%), Sri Lanka (25%), and Mauritius (14%).

To enhance defense exports, the Ministry of Defence has rolled out initiatives aimed at boosting export capacities, with dedicated funds to expand outreach to an additional 34 countries. These strategic policies—coupled with investments in export-centric defense manufacturing—have the potential to elevate India’s defense exports significantly.

Should India’s defense exports evolve in alignment with Israel’s success in the sector, it could present a compelling case for long-term investment in defense stocks.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com