The current market scenario exhibits considerable volatility, particularly within the banking sector. The Nifty Bank index, which soared to a record high of 53,300 in July, has since encountered downward pressure, primarily due to profit-taking activities. As of now, this index is down over 2.5% from its peak, with noticeable disparities in the performance of government versus private banking stocks. The Nifty PSU Bank index, representing public sector banks, has declined by 16.61% from its record high, while the Nifty Private Bank index has only seen a marginal drop of 2.16%. Overall, the Nifty Bank index has retracted by 2.66% from its all-time high.

When evaluating individual banking stocks, private banks appear to present a more substantial growth potential than their public sector counterparts. Analysts forecast returns of up to 65% for private banking stocks and around 50% for public sector banks. Notably, three private banks—HDFC Bank, ICICI Bank, and Axis Bank—have garnered positive sentiment, with none of the covering analysts recommending a sell rating on these stocks.

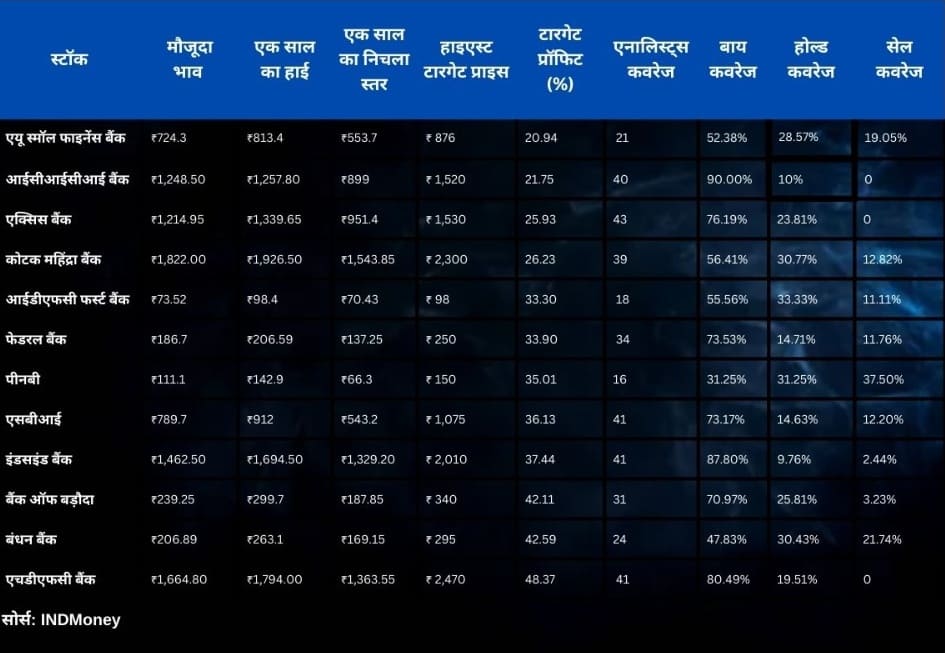

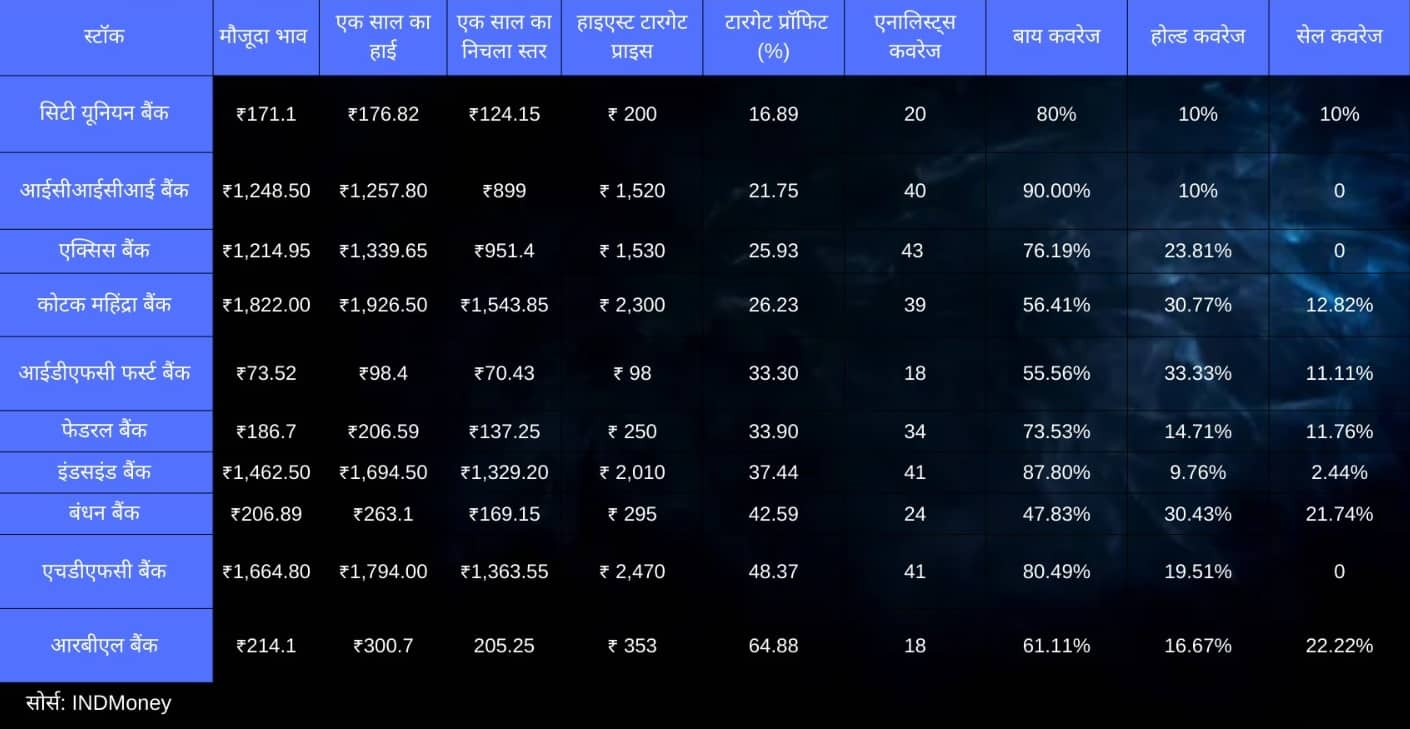

Top Nifty Bank Stocks with Earning Potential

HDFC Bank stands out among the 12 Nifty Bank constituents as having the most considerable upside potential from current price levels. Out of 41 covering brokerages, the maximum target price for HDFC Bank is set at ₹2,470, implying an upside of 48.37%. In addition to HDFC Bank, the stocks of ICICI Bank and Axis Bank remain in analysts’ good graces, as they have not received any sell recommendations. Below, we detail the performance metrics of Nifty Bank stocks, including current prices, one-year high and low prices, target prices, and analyst ratings.

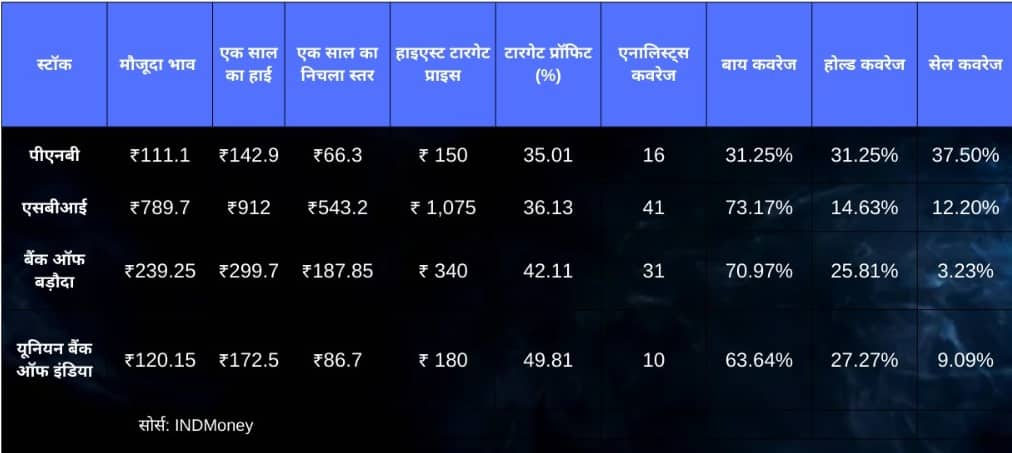

Comparative Analysis of Public and Private Bank Shares

Analysts have shared insights regarding four of the twelve stocks in the Nifty PSU Bank index. Among these, Bank of Baroda and State Bank of India (SBI) have garnered significant bullish sentiment, with over 70% of analysts recommending a buy rating. The best investment opportunities within the public sector appear to be Union Bank of India, expected to yield a potential profit of nearly 50%, and Bank of Baroda, which could deliver a 42% return based on the analysts’ highest target prices.

Potential Returns from Private Banks

Shifting focus to private banking stocks, none of the analysts covering the ten Nifty Private Bank stocks have suggested selling HDFC Bank, ICICI Bank, or Axis Bank—indicative of their strong performance outlook. Furthermore, RBL Bank emerges as a notable opportunity, with analysts projecting a potential upside of approximately 65% from current valuations.

Nifty Index Performance Summary

As of September 13, the Nifty Bank index is positioned at 51,938.05, having reached an intra-day high of 53,357.70 on July 4, 2024. The Nifty Private Bank index concluded at 26,075.55, while the Nifty PSU Bank index closed at 6,715.3 on the same day. Notably, the Nifty Private Bank index hit a one-day high of 26,653.55, and the Nifty PSU Bank recorded a high of 8,053.30 on July 3, 2024.

Important Note: The current price values reflect the closing figures from September 13 on NSE.

Disclaimer: The views and opinions expressed in this article represent the personal perspectives of analysts and brokerage firms. The site and its management are not accountable for these views. It’s recommended to seek advice from certified experts before making any investment decisions.