Sahasra Electronics Solutions made a remarkable entry into the stock market on October 4, 2023, with its shares debuting at ₹537.70 on the NSE SME platform. This listing represents an impressive premium of 90% over the IPO issue price of ₹283. The SME IPO, valued at ₹186.16 crore, was open for subscription from September 26 to September 30, with a price range of ₹269 to ₹283 per share. This successful launch highlights the increasing interest and confidence investors have in the burgeoning electronics sector.

This issue consisted of a fresh issue of 60.78 lakh shares, amounting to ₹172.01 crore, alongside an offer for sale of 5 lakh shares, aggregating to ₹14.15 crore. The IPO garnered an overwhelming response, with a total subscription rate of 122 times, indicating robust investor demand. Specifically, the non-institutional investor (NII) segment was oversubscribed by an astonishing 260 times, while the retail portion saw an oversubscription of 74.85 times. Such response showcases the high levels of investor optimism for emerging enterprises like Sahasra Electronics Solutions.

The qualified institutional buyer (QIB) segment also demonstrated strong interest, being fully subscribed at 100.80 times, which portrays the confidence institutional investors have in the company’s business model and future prospects.

Utilization of IPO Proceeds

Sahasra Electronics Solutions plans to use the net proceeds from the IPO for various critical purposes. A significant portion will fund capital expenditures for the installation of additional plant and machinery at a new manufacturing facility located in Bhiwadi, Rajasthan. This expansion plan aims to enhance the company’s production capacity and streamline operations to meet the growing demand in the electronics market.

Investment in Subsidiaries

Additionally, a portion of the proceeds will be directed towards supporting its subsidiary, Sahasra Semiconductors Private Limited, thereby addressing its capital expenditure demands for further installations. The funds will also cater to the company’s working capital requirements and general corporate purposes, ensuring stable operations and growth.

About Sahasra Electronics Solutions

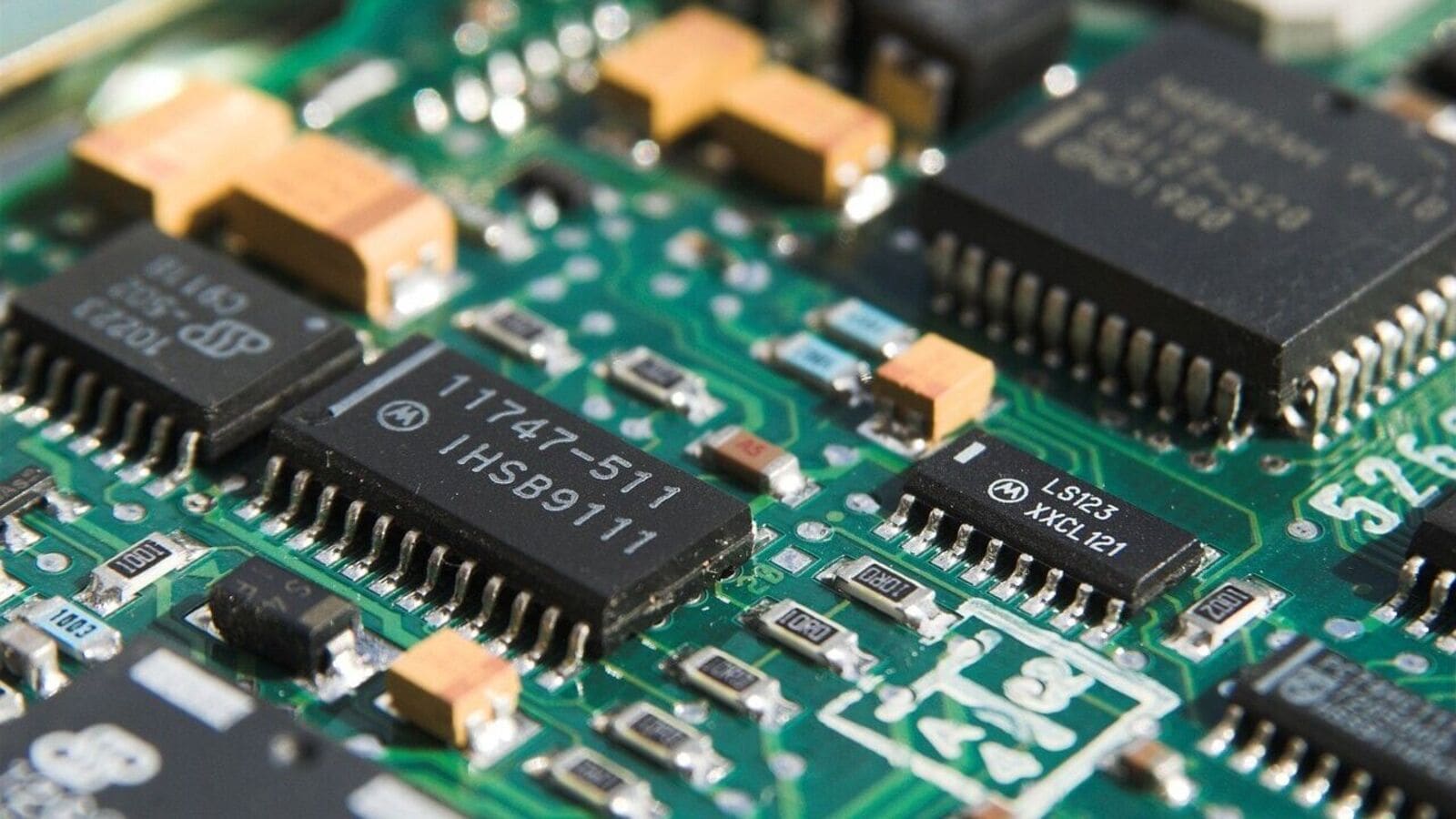

Sahasra Electronics Solutions specializes in providing comprehensive electronics system design and manufacturing (ESDM) solutions. The company’s diverse offerings include printed circuit board (PCB) assembly, box build services, LED lighting, memory components, IT accessories, and computer hardware. By leveraging advanced technology and skilled expertise, the company delivers high-quality products tailored to meet various client needs.

Global Market Reach

In fiscal year 2024, Sahasra Electronics Solutions exported more than 80% of its product and solution offerings to global manufacturers. Its international clientele spans countries such as the United States, Rwanda, Tunisia, the United Kingdom, Germany, Canada, Austria, and Belgium. This extensive global outreach not only amplifies the company’s market presence but also fortifies its position in the competitive electronics landscape.

Customer Base Expansion

The company has significantly expanded its customer base, growing from approximately 20 clients in fiscal year 2022 to around 40 clients by fiscal year 2024. This diversification across various end-use industries—including railways, aerospace, marine, automotive, healthcare, and IT hardware—has effectively mitigated customer concentration risk, as highlighted in the company’s Draft Red Herring Prospectus (DRHP).

Disclaimer: The insights and forecasts mentioned above belong to various analysts and market experts and do not reflect the views of Sahasra Electronics Solutions or other affiliated parties. Investors are encouraged to seek advice from certified financial professionals before making any investment decisions.