The allotment status for Sahasra Electronics IPO is anticipated to be finalized today. Investors eager to discover their allotment can easily access this information through the registrar, Bigshare Services, or on the National Stock Exchange (NSE) website. The IPO was open for subscription from September 26 to September 30 and demonstrated a remarkable response from investors, with an oversubscription rate of 122 times, indicating strong market interest.

Breaking down the oversubscription rates, the non-institutional investor (NII) segment was notably oversubscribed at 260.46 times, while the retail investors’ portion saw an oversubscription rate of 74.85 times. Furthermore, the qualified institutional buyers (QIB) segment was also popular, being booked at 100.80 times. The price range for the IPO was set between ₹269 and ₹283 per share.

Due to the high demand among retail investors, shares will be distributed to retail individual investors (RIIs) in a proportional manner. Investors who are not allotted shares can expect the refund process to commence on October 03, 2024, ensuring a smooth financial transition for all participants.

For those successful in the allotment, the shares will be credited to their demat accounts on the same day as refunds, with the SME IPO expected to debut on the NSE SME platform, tentatively scheduled for October 4, 2024.

Sahasra Electronics plans to utilize the net proceeds from this IPO for several crucial initiatives. These include funding capital expenditures that are essential for the installation of additional machinery at a new manufacturing facility located in Bhiwadi, Rajasthan. This expansion is anticipated to significantly enhance production capacity.

A portion of the funds raised will also be allocated to Sahasra Semiconductors Private Limited, aiming to support its capital expenditure needs for further installations. Additionally, the proceeds will assist in meeting working capital requirements and catering to various general corporate purposes.

Steps to Check Allotment Status Online

As the registrar for the SME IPO, Bigshare Services Pvt Ltd provides a user-friendly platform for investors to check their allotment status online. Below are the steps to follow:

Checking Allotment Status on NSE’s Website

You can also check your allotment status via the NSE portal by following these steps:

About Sahasra Electronics

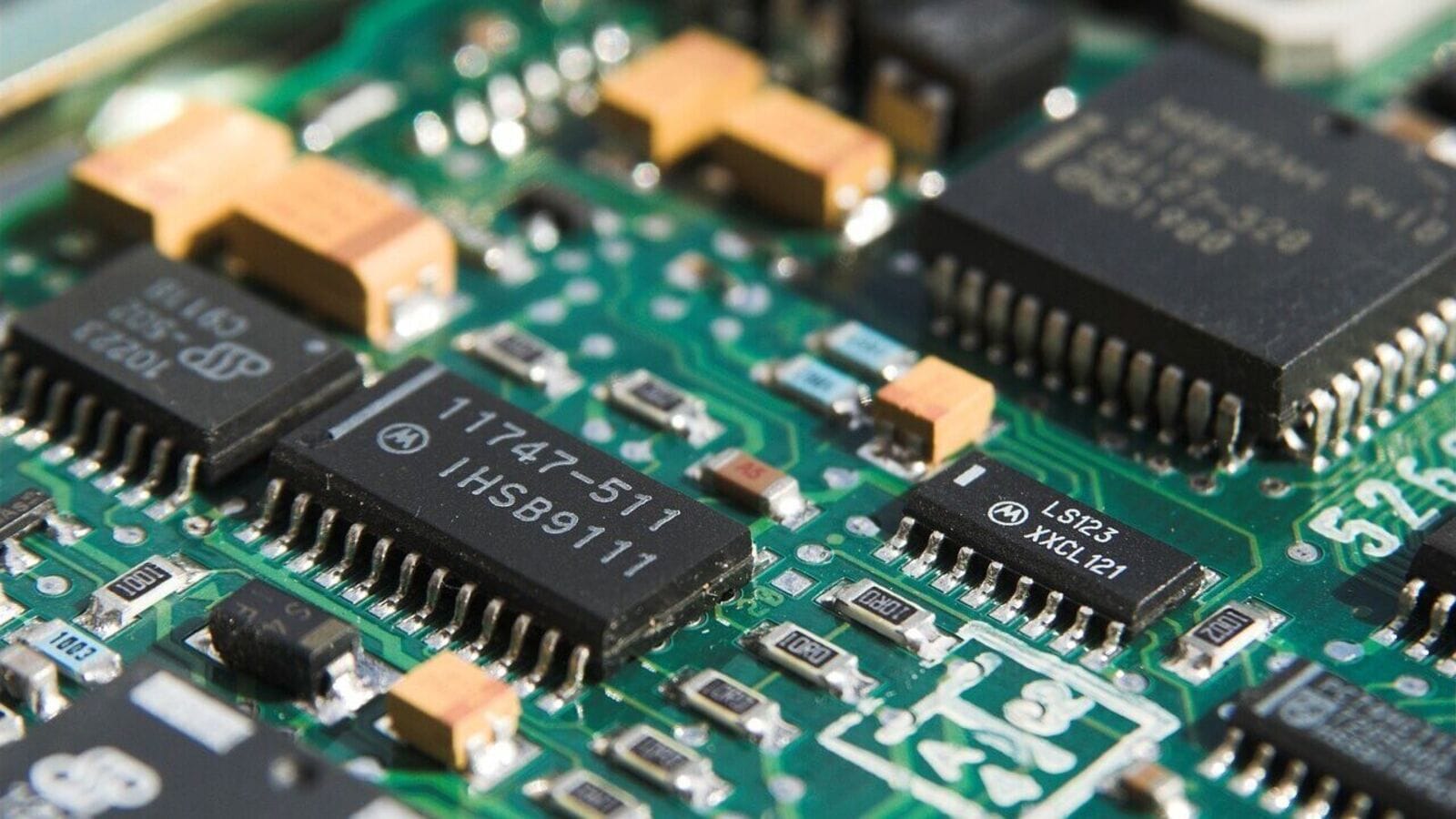

Sahasra Electronics specializes in providing electronics system design and manufacturing (ESDM) solutions. Their product range includes printed circuit board (PCB) assembly, box build services, LED lighting, memory components, IT accessories, and other computer hardware solutions.

In the fiscal year 2024, more than 80% of the company’s products were exported to international manufacturers across various countries including the United States, Rwanda, Tunisia, the United Kingdom, Germany, Canada, Austria, and Belgium, showcasing its strong global presence.

The company has significantly expanded its client base, growing from approximately 20 customers in fiscal 2022 to around 40 customers in fiscal 2024. This diversification across numerous end-use industries—such as railways, aerospace, marine, automotive, healthcare, and IT hardware—has effectively reduced customer concentration risk, bolstering the company’s stability in the market.