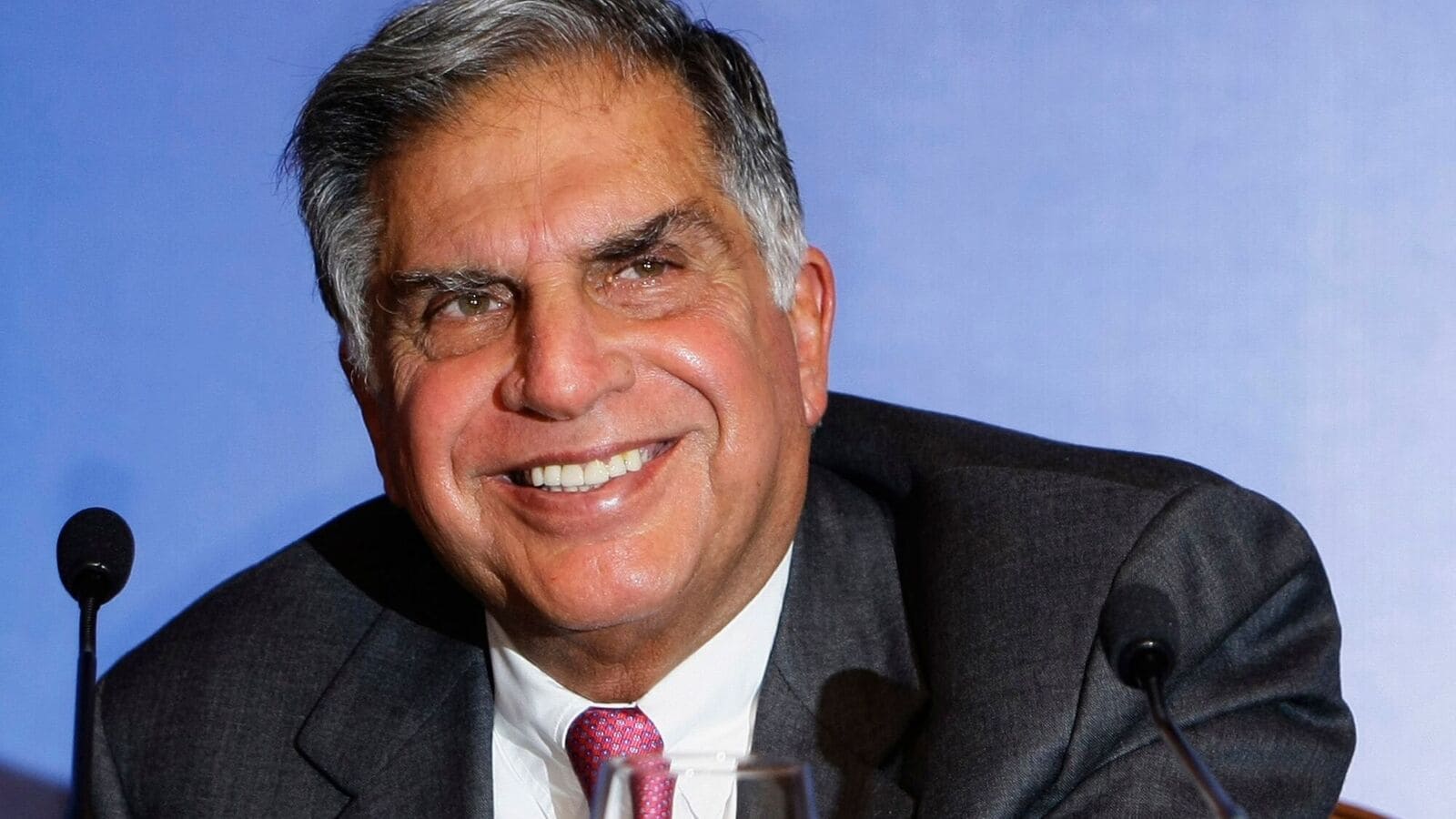

The recent passing of Ratan Tata, the esteemed chairman emeritus of Tata Sons, has cast a profound shadow over the Indian business landscape. As a visionary industrialist who helped shape one of India’s most iconic conglomerates, Tata Group, his contributions have left an indelible mark on the nation. Following his demise on Wednesday night, Tata Group stocks are poised to capture the attention of investors and market analysts alike during Thursday’s trading session.

In a heartfelt media statement, N Chandrasekaran, the current chairman of Tata Sons, expressed deep condolences for the loss of Ratan Tata. He emphasized the monumental influence Tata had on India’s corporate fabric, underscoring that his remarkable vision and leadership will be sorely missed.

Chandrasekaran remarked, “It is with a profound sense of loss that we bid farewell to Mr. Ratan Naval Tata, a truly remarkable leader whose immeasurable contributions have shaped not only the Tata Group but also the very essence of our nation.”

Current Performance of Tata Group Stocks

In recent months, Tata Group stocks have demonstrated impressive growth, marking a 15.4% increase in collective market capitalization since June 2024. This surge is largely attributed to robust performances from powerhouse companies within the conglomerate, including Tata Consultancy Services (TCS) and Tata Motors. Investors are keen to see how Tata stocks will respond in light of this significant leadership transition.

Market analysts have noted that Tata Group stocks provide diversification across a wide array of sectors, consistent dividend yields, and considerable potential for capital appreciation. These factors position Tata stocks as a viable long-term investment opportunity for wealth generation.

As the Tata Group enters a new chapter following Ratan Tata’s passing, there will be heightened scrutiny on the conglomerate’s succession planning. The clarity and effectiveness of this plan could significantly influence the performance of Tata stocks in the Indian stock market moving forward.

Upcoming TCS Q2 FY25 Earnings Announcement

On a related note, Tata Consultancy Services (TCS) is scheduled to release its earnings report for the quarter ending September 30, 2024, generating further excitement in the markets. The company has communicated this development through an official exchange filing, and analysts are keenly anticipating the financials.

The board meeting of Tata Communications is also slated for Thursday, October 17, 2024, to discuss the unaudited standalone and consolidated financial results for the quarter and half-year ending September 30, 2024. This announcement indicates a busy period for the Tata Group as stakeholders eagerly await key financial insights.

On October 9, TCS shares closed positively, gaining 0.13% to ₹4,258 per share on the National Stock Exchange (NSE), just one day before their much-anticipated earnings report.

Recent IPO Success – Tata Technologies

In a notable achievement for the Tata Group, Tata Technologies recently made waves with its initial public offering, which was among the most anticipated IPOs of 2023. This marks a significant milestone as it was the first IPO for the Tata Group in over 19 years.

Tata Technologies’ IPO, launched in November 2023, saw remarkable interest, closing with the third-highest gains on its listing day in the history of the Indian capital market. The company opened at ₹1,200 and closed at ₹1,328 on the NSE, reflecting a stunning 140% premium on the IPO price.

The IPO consisted of an offer-for-sale of 6.08 crore shares from key promoters, including Tata Motors, Alpha TC Holdings, and Tata Capital Growth Fund 1. The offering attracted overwhelming interest with more than 73.38 lakh applications, resulting in an extraordinary oversubscription rate of 69.43 times.