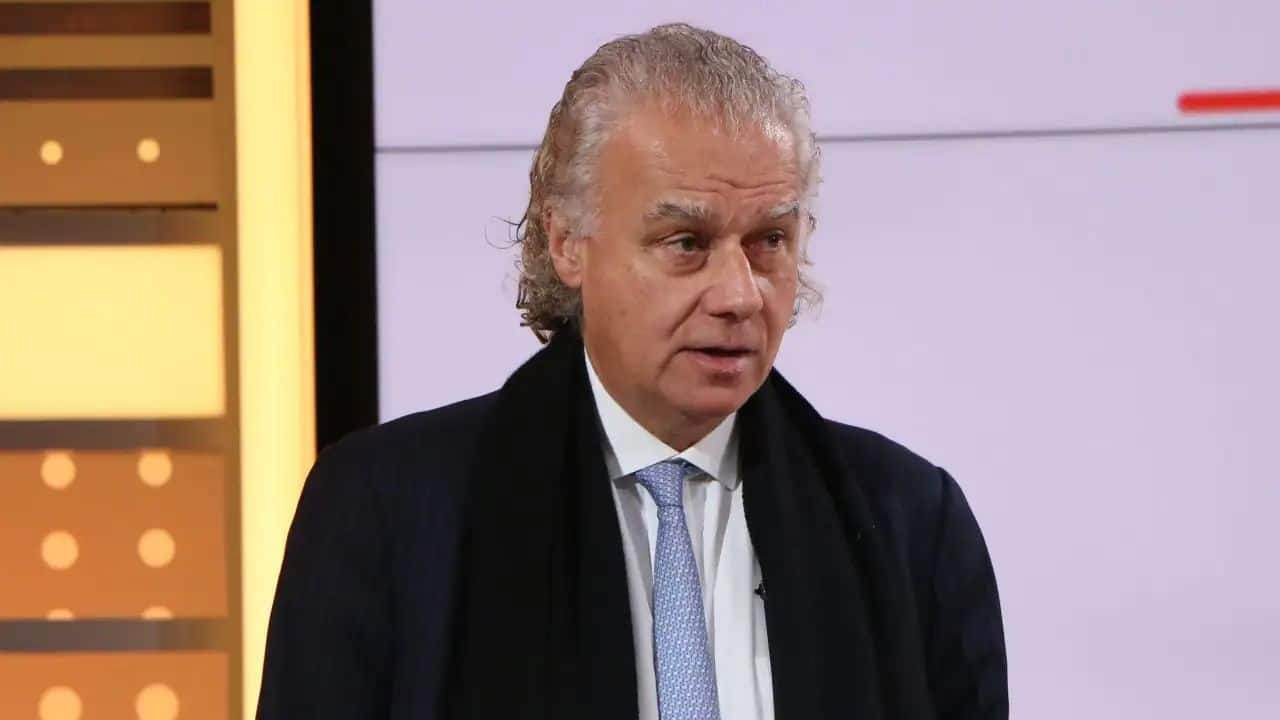

Investment Strategy Insights by Christopher Wood

Christopher Wood, the global head of equity strategy at Jefferies, recently revised his investment outlook by slightly reducing the allocation to Indian equities while continuing to express an overall positive sentiment towards the market. Despite a one percent decrease in the weight of Indian stocks, Wood maintains an ‘overweight’ rating, implying a belief that Indian stocks will outperform the market in the long haul. Additionally, the brokerage firm has decided to increase its weight on Chinese stocks by two percent, signaling a shift in focus towards opportunities in Asia.

Strategic Adjustments in Weight Allocations

In his latest note, Wood outlined that the weight of Malaysia’s equities has been trimmed by half a percent alongside a similar reduction in Australia’s weightage. Despite these adjustments, both Indian and Malaysian markets retain their ‘overweight’ status, indicating that Jefferies still sees potential for growth in these regions.

Geopolitical Risks Affecting Market Dynamics

Wood’s adjustments come amid rising geopolitical tensions that pose significant risks to global equity markets. He cautioned that the escalation of conflicts in regions such as West Asia and the ongoing Russia-Ukraine war could adversely affect markets worldwide, including India. Woods emphasized that the market’s current positioning does not fully account for the potential fallout from these geopolitical crises.

The Impact of Current Events on Market Behavior

The context of Wood’s analysis is particularly relevant as traders worldwide experience heightened caution linked to the escalating situation in the Middle East. Following a significant attack by Iran on Israel using 200 ballistic missiles on October 1, tensions have surged, and the potential for retaliation from Israel looms large. The crisis began at 7:30 PM local time in Israel, and security forces reported that several missiles were intercepted. This geopolitical turmoil has prompted fluctuations in crude oil prices, along with a noted downturn in U.S. stock indices.

| Region | Weight Adjustment | Current Rating |

|---|---|---|

| India | -1% | Overweight |

| China | +2% | Positive Outlook |

| Malaysia | -0.5% | Overweight |

| Australia | -0.5% | Neutral |

Conclusion

As geopolitical risks continue to loom large, investment strategies are being finely tuned to navigate the uncertain landscape. Christopher Wood’s analysis highlights the importance of remaining vigilant to global developments while recognizing the growth potential in markets like India and Malaysia. Investors would do well to keep an eye on the evolving global situation, particularly in the Middle East, as it unfolds.