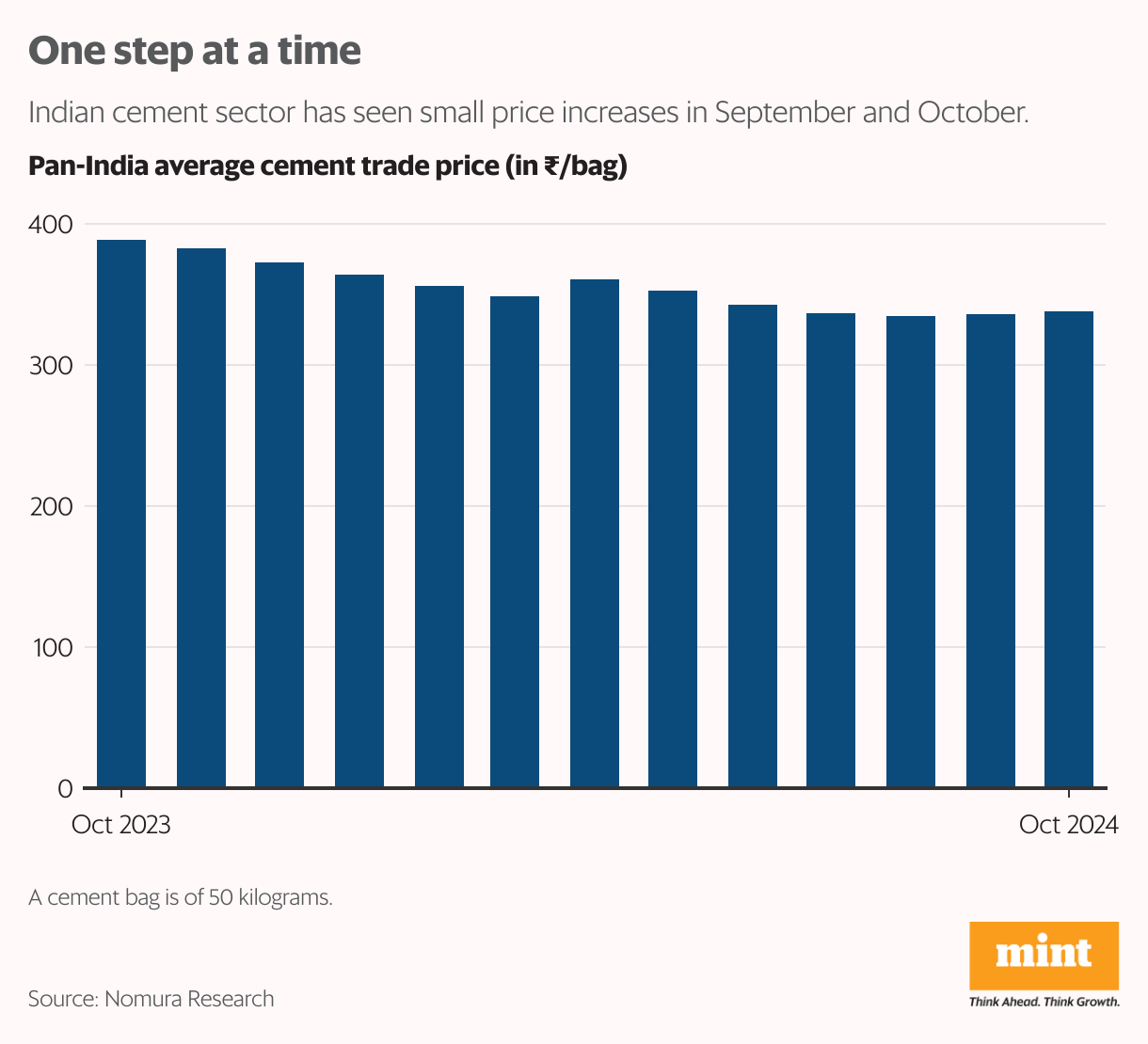

In October, cement prices have shown a slight increase for the second month in a row. Although the increment is minor, it brings a sense of relief to investors, especially considering the troubling price trends that have adversely affected the sector’s realization outlook in recent months.

Following a significant downturn, where cement prices touched a three-year low in the September quarter (the financial second quarter of 2024-25), the pan-India average trade price has risen modestly. As of early October, the average price increased by ₹2 per bag, bringing it to ₹338 per bag, according to a dealer channel check conducted by Nomura Global Markets Research on October 9. In the cement trade segment, the product moves from manufacturing companies to dealers, who then sell it to end consumers.

In September, the price had also experienced a slight uptick, rising by ₹1 per bag month-on-month.

However, this price increase is not uniform across the country. Notably, western India has recorded the most significant rise, with an increase of ₹8 per bag month-on-month, while other regions are facing challenges. According to Nomura’s report, the competitive landscape in eastern India, coupled with heavy rains in the central region, has led to price drops of ₹5 and ₹3 per bag, respectively.

A Surge in Demand

A few months back, cement companies had to retract their price increases due to lackluster demand amidst stiff competition. Forecasts suggest that demand in the second half of FY25 is likely to surpass that of the first half, though the sustainability of these price increases remains uncertain.

Following the festival season, cement demand is projected to rise during the ongoing third quarter (October to December), with a more substantial uptick expected in the fourth quarter—a period traditionally marked by heightened infrastructure and home-building activities. However, after a sluggish sales volume growth in the first half of FY25, cement manufacturers may prioritize pushing volumes in the latter half, which could negatively impact the pricing outlook.

Furthermore, major cement manufacturers are undergoing a capacity expansion frenzy, particularly through acquisitions, which may lead to price reductions as companies prioritize volume over realizations. The ongoing consolidation within the sector is anticipated to increase, thus granting larger firms greater market share and production capabilities.

Nonetheless, if demand does not recover significantly, the additional cement supply from these recent expansions could exert downward pressure on prices. Therefore, even though minor price hikes may persist, they may not be adequate to significantly improve the sector’s near-term realization outlook.

In general, overall cement volumes are expected to grow by about 4-5% in FY25, influenced by factors such as the upcoming general election, a slowdown in construction activities, and the impact of a higher base. This growth rate reflects a notable slowdown from earlier expectations of 7-8% year-on-year growth and represents a sharp deceleration from approximately 9% year-on-year growth seen in FY24, as noted in a report by Nuvama Research on October 11.

Easing Input Costs

A positive development for the cement sector is the easing of input costs. The prices of imported petroleum coke and coal have decreased sequentially in the second quarter, with the benefits of this decline expected to be realized in the third and fourth quarters of FY25. This relief is likely to bolster profitability and mitigate some of the adverse effects from weak pricing conditions.

Currently, cement companies face the risk of further earnings downgrades, especially following a weak performance in the first half of the financial year. Notable cement stocks, including UltraTech Cement Ltd, ACC Ltd, and Ambuja Cements Ltd, have provided returns ranging from 5% to 13% in 2024 thus far, although their valuations remain relatively unattractive.

According to Kotak Institutional Equities’ report dated October 10, “We expect Q2FY25 to be a washout quarter, but a reversal with a price hike in September and seasonal tailwinds of H2 suggests a sequential recovery in margins in H2FY25E.” The brokerage has revised its earnings and fair value estimates for cement stocks within its coverage and warns of considerable risk to consensus earnings projections for FY26.