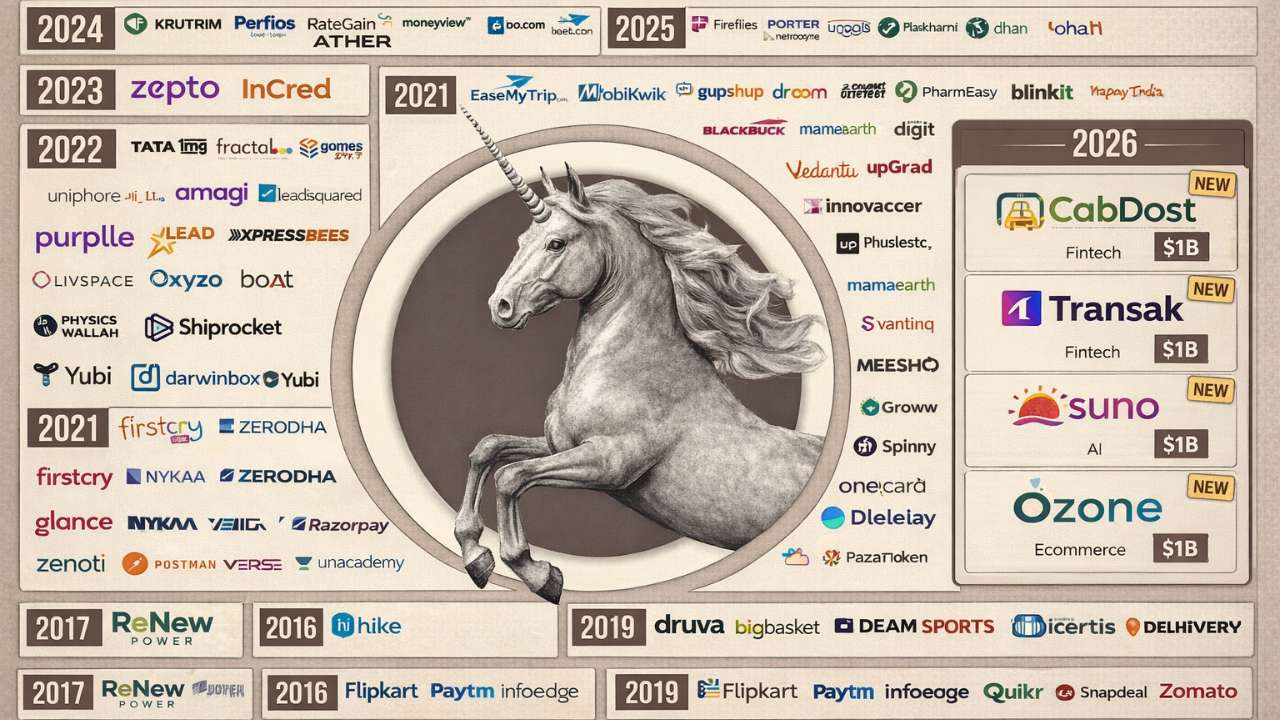

India’s startup ecosystem strengthened further in 2025, with more than 126 firms attaining unicorn status and raising over $117 billion collectively, underscoring the country’s emergence as a major global startup hub driven by scale, technology adoption and revenue-led growth.

Broader sector participation beyond fintech and e‑commerce

The unicorn club is no longer dominated solely by fintech and e‑commerce. Logistics, artificial intelligence, enterprise software and consumer brands have become significant contributors, reflecting diversified investor interest and the maturation of India’s innovation landscape.

Funding environment: slower pace, higher quality

After the rapid creation of unicorns in 2021, global liquidity tightening and cautious investor sentiment moderated the pace of new billion‑dollar startups. That restraint pushed founders to prioritise operational efficiency, sustainable unit economics and governance over valuation‑first strategies.

In 2025 six startups—Netradyne, Porter, Drools, Fireflies.ai, Jumbotail and Dhan—crossed the $1 billion threshold, representing a mix of B2B, B2C and technology‑led businesses. Observers view this measured growth as a sign of a more mature ecosystem focused on long‑term value creation.

Fintech and e‑commerce remain key engines

Fintech continues to be a major driver of unicorn formation, with platforms across trading, payments, lending and wealth management scaling rapidly amid rising digital adoption. New fintech unicorns such as Dhan exemplify how technology‑first financial services can expand user reach by emphasising transparency and customer experience.

At the same time, e‑commerce and consumer brands—illustrated by firms such as Jumbotail and Drools—are scaling through deep distribution networks, regional penetration and robust supply chains, tapping into India’s expanding middle class and growing online consumption.

Geography: Bengaluru retains its lead

Bengaluru remains the preferred base for many unicorns, buoyed by its deep talent pool, strong startup culture and investor presence. Delhi NCR and Mumbai also play central roles in fundraising and new unicorn creation, together forming the backbone of India’s startup economy.

Valuation dynamics shifting toward stability

By late 2025, Indian unicorns’ aggregate valuation stood at about $389 billion. While some companies faced valuation corrections, many responded by improving revenue visibility and exercising tighter cost discipline. Investors—both domestic and international—are increasingly directing capital to ventures with clear governance, scalable business models and demonstrable path-to-profitability.

Faster routes to unicorn status in select cases

Several companies have reached unicorn status in record time, driven by execution speed, strong branding and acquisition strategies. Examples such as Mensa Brands and GlobalBees, which scaled rapidly under concentrated growth models, highlight India’s capacity to build globally competitive businesses quickly when market fit and execution align.

Selected unicorns and recent additions

The following table lists a cross‑section of companies that have achieved unicorn status in recent years, their sectors, founding year, time taken to reach unicorn valuation, current valuation and primary investors. The list reflects sectoral breadth—covering fintech, enterprise tech, logistics, consumer brands and AI—and geographic spread across India’s startup hubs.

(Table omitted for brevity in this version. Full company-level data is available from industry trackers and regulatory filings.)

Outlook

India’s unicorn narrative is entering a more balanced phase: startups are shifting attention from headline valuations to profitability, sound unit economics and sustainable growth. With a large domestic market, improving digital infrastructure and abundant entrepreneurial talent, India is well positioned to continue producing unicorns across diverse sectors as investors remain selective but optimistic.