Introduction

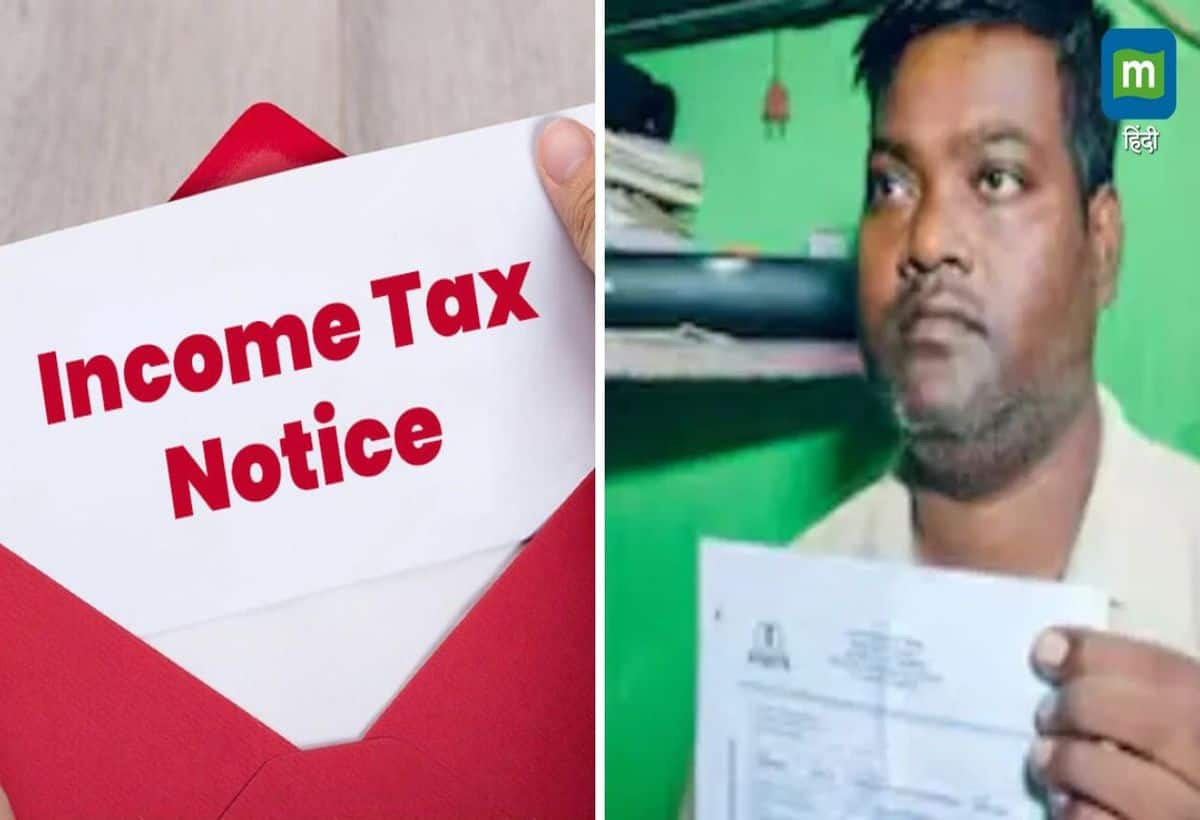

In a shocking turn of events, Rajiv Kumar, a resident of Gaya district in Bihar, has found himself embroiled in a perplexing situation with the Income Tax Department. Despite earning a modest income of just ₹10,000 per month from his job, Rajiv has received a staggering tax notice amounting to ₹2 crore. This unexpected financial burden has left him and his family in a state of disbelief and uncertainty.

The Notice

Rajiv, who identifies as a minor laborer, has been visiting the Income Tax Department’s office for the past four days, desperately seeking clarity regarding the notice. The message he received accuses him of making a Rs 2 crore fixed deposit in the financial year 2015-16, claiming he failed to file necessary tax returns or pay due taxes. Rajiv, however, insists that he only deposited ₹2 lakh in Corporation Bank and withdrew it before maturity in August 2016.

The Background

Rajiv’s journey began on January 22, 2015, when he made a fixed deposit of ₹2 lakh. This foundational investment was utilized before maturity, and he never anticipated facing a tax implication of such magnitude. Rajiv remarks, “Even if I spent my entire life working as a laborer, I would never reach such a large sum.” His situation emphasizes the importance of understanding tax regulations, particularly among low-income individuals who may not be well-versed in financial matters.

Steps to Address the Situation

Upon receiving a notice like Rajiv’s, individuals are encouraged to take specific actions to resolve the issue. Here’s a summarized table of the steps to follow:

| Step | Description |

|---|---|

| 1. Appeal to the Income Tax Department | File a formal appeal against the notice, explaining the situation in detail. |

| 2. Gather Documentation | Collect essential documents such as bank statements, PAN card, and proof of income. |

| 3. Submit an Application | Provide all gathered documents along with your appeal to support your claims. |

| 4. Follow Up | Continuously follow up with the Income Tax Department for updates and potential resolutions. |

Conclusion

Rajiv’s experience sheds light on the vulnerabilities faced by individuals who may lack financial literacy. As he navigates through this confusing maze of taxation, it serves as a reminder of the critical importance of awareness, documentation, and prompt action in dealing with financial matters. The Income Tax Department has suggested that Rajiv file an appeal to correct the potential technical mistake in the notice, providing him hope for a resolution to this alarming situation.