Introduction

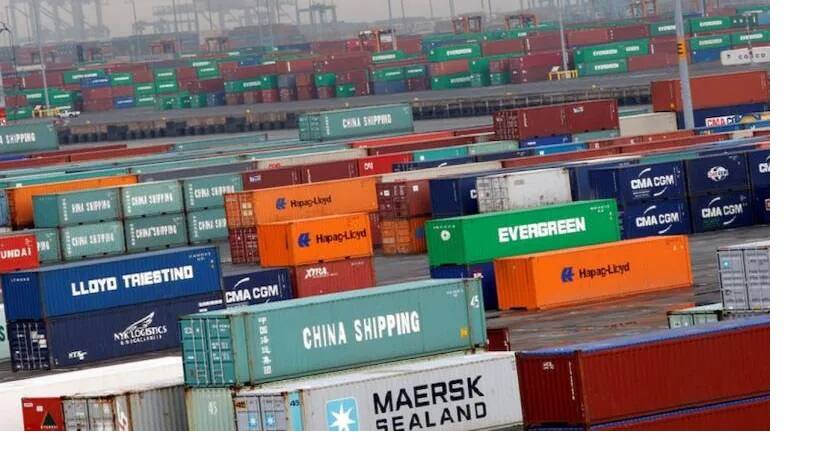

HSBC Mutual Fund has recently launched the India Export Opportunities Fund, a targeted investment vehicle designed for those looking to benefit from the growth of Indian exports. This unique thematic fund will selectively invest in companies that derive a significant portion of their revenue from exports, specifically those with export revenues exceeding 20%. Investors can participate in this fund until September 18, 2024, positioning themselves to capitalize on the expanding global market and the government’s pro-export policies.

Investment Strategy

The India Export Opportunities Fund focuses on companies with strong corporate governance, robust cash flow, and proper valuation metrics. While adhering primarily to its export-centric theme, the fund allows for up to 20% leeway in diversifying its investments outside this theme. This flexibility enables the fund manager to hedge risks and seize additional growth opportunities across various sectors.

Sectors of Interest

This fund’s investment strategy encompasses a diverse range of sectors, including but not limited to:

- Automobiles and Auto Components

- Industrial Products and Manufacturing

- Electrical Equipment

- Pharmaceuticals and Biotechnology

- Chemicals

- Textiles and Apparels

- Construction

- Agriculture and Food

- Petroleum Products

- Metals

- IT Software and Services

- Telecom Services

Importantly, the fund will not invest in sectors reliant solely on domestic markets, such as banking, real estate, and insurance, thereby aligning its performance directly with the health of India’s export sector.

Market Outlook

India has set an ambitious target of reaching $2 trillion in exports by 2030, necessitating a compounded annual growth rate of 15%. This goal reflects the government’s commitment to enhancing export performance through various reforms, improved labor conditions, and diversified supply chains. According to Venugopal Mangat, CIO (Equity) at HSBC Mutual Fund, there are 310 companies that meet the fund’s criteria, comprising 235 exporters of goods and 75 exporters of services, including 31 large-cap, 40 mid-cap, and 239 small-cap firms.

Portfolio Composition

The fund will primarily focus on large-cap stocks, though its approach remains flexible. Notably, stocks from the IT, pharmaceuticals, and automobile sectors are likely to represent a significant portion of the portfolio. The exclusion of banking sector stocks aims to mitigate risks associated with the current domestic market landscape.

Investor Perspective

Recently, interest in thematic and sector-focused funds has surged. Data indicates that net inflows into these categories have outstripped other mutual funds, with a substantial net inflow of ₹1.2 lakh crore over the past year alone. Currently, the HSBC India Export Opportunities Fund stands alongside the ICICI Prudential Exports and Services Fund, which has consistently outperformed market benchmarks over varying time frames—averaging returns of 22% over three years, 24.4% over five years, and 17.3% over seven years.

Risk Considerations

Investors must be mindful that thematic and sector funds carry a higher risk profile and are not suitable for all investors. It is essential to thoroughly understand the dynamics of this fund, as the path may involve fluctuations and volatility. If you are equipped to navigate these challenges, the India Export Opportunities Fund could present a valuable investment opportunity in the growing export sector of India.