MUMBAI: In recent market activity, Angel One Ltd has seen its stock rise approximately 7% over the past two trading sessions. This boost comes in the wake of the company’s announcement regarding the introduction of brokerage fees for cash delivery trades. Investors and analysts alike are reacting positively to this strategic shift, as it is expected to yield financial benefits that may mitigate the challenges posed by newly enforced true-to-label pricing norms.

The upward trajectory of Angel One’s stock suggests that the market anticipates minimal negative repercussions on options trading volumes despite the recent changes mandated by the Securities and Exchange Board of India (SEBI) concerning derivative trading. Furthermore, the company is believed to be well-positioned to retain its client base in the cash market, despite competitor offerings of zero-fee trading.

However, relying on such assumptions may carry inherent risks.

Angel One has taken significant steps by discontinuing its zero-brokerage policy for equity delivery transactions. The firm will now impose a brokerage fee of ₹20 per order or 0.1% of the transaction value, depending on which is lower. This move was anticipated, especially given the recent transition to true-to-label pricing regulations. Previously, Angel One had the ability to generate additional income through incentives provided by exchanges based on transaction volumes. However, this avenue has been restricted due to the new pricing regulations.

In the first quarter of fiscal year 2025 (Q1FY25), Angel One accumulated ₹110 crore in incentives from exchanges, accounting for approximately 10% of its total fees and commission income. If the company can sustain its cash delivery orders at 60 million—similar to figures reported in Q1FY25—it stands to generate about ₹120 crore to help counteract the effects of true-to-label pricing. This projection is based on a fee of ₹20 per order without losing any clients.

The Challenges Ahead

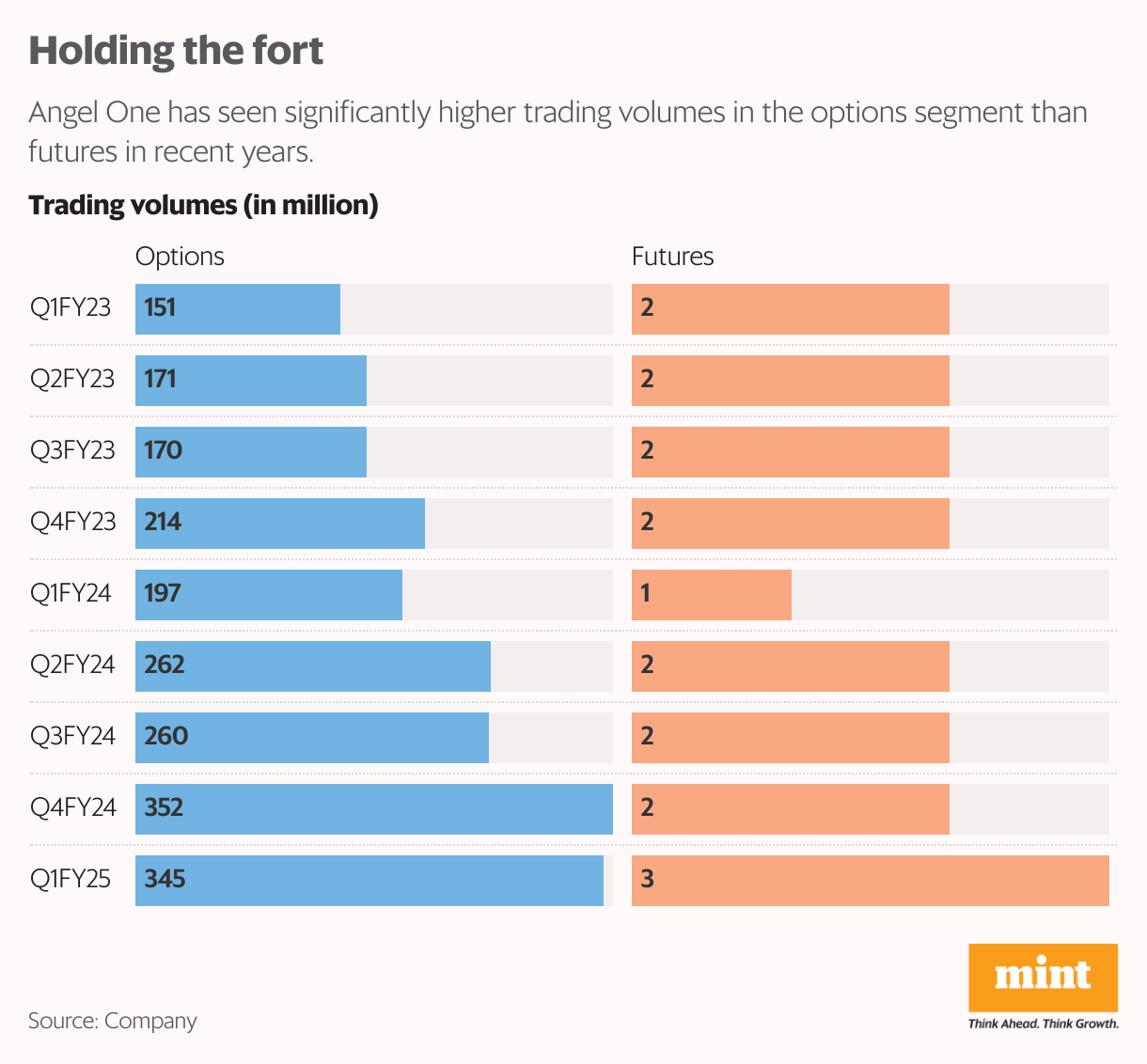

Nonetheless, there are notable concerns regarding the potential decline in options trading volumes. This could be particularly acute if trading in futures and options (F&O) diminishes due to the new regulations set by SEBI. A key regulation limits each exchange to hosting just one options expiry per week. The introduction of weekly expiries in FY19 has greatly contributed to the surge in options trading activity. During Q1FY25, Angel One executed a staggering 348 million orders in F&O, with 345 million of those being options transactions.

Compounding these issues, rival broker Zerodha has yet to announce any brokerage fees for cash delivery transactions, maintaining a zero-cost model for its clients. This could pose a substantial risk for Angel One in terms of customer retention. Additionally, the stock’s valuation has experienced a noticeable decline, dropping from a peak of 25x earnings in January to 17x based on the fiscal year 2025 Bloomberg consensus earnings per share.

| Parameter | Q1FY25 | Expected |

|---|---|---|

| Cash Delivery Orders (Million) | 60 | 60 |

| Incentives from Exchanges (₹ Crore) | 110 | 120 |

| F&O Orders (Million) | 348 | N/A |

| Options Orders (Million) | 345 | N/A |

| Stock Valuation (x Earnings) | 17 | 25 (Peak) |