Avenue Supermarts Ltd., the company behind the widely popular DMart supermarket chain, witnessed a dramatic decline in its share price on Monday, plummeting over 8%. This downturn came in the wake of the company’s second-quarter earnings report (Q2FY25), which fell short of market expectations. The results have raised alarms about its future growth prospects, particularly as competition from quick commerce companies intensifies.

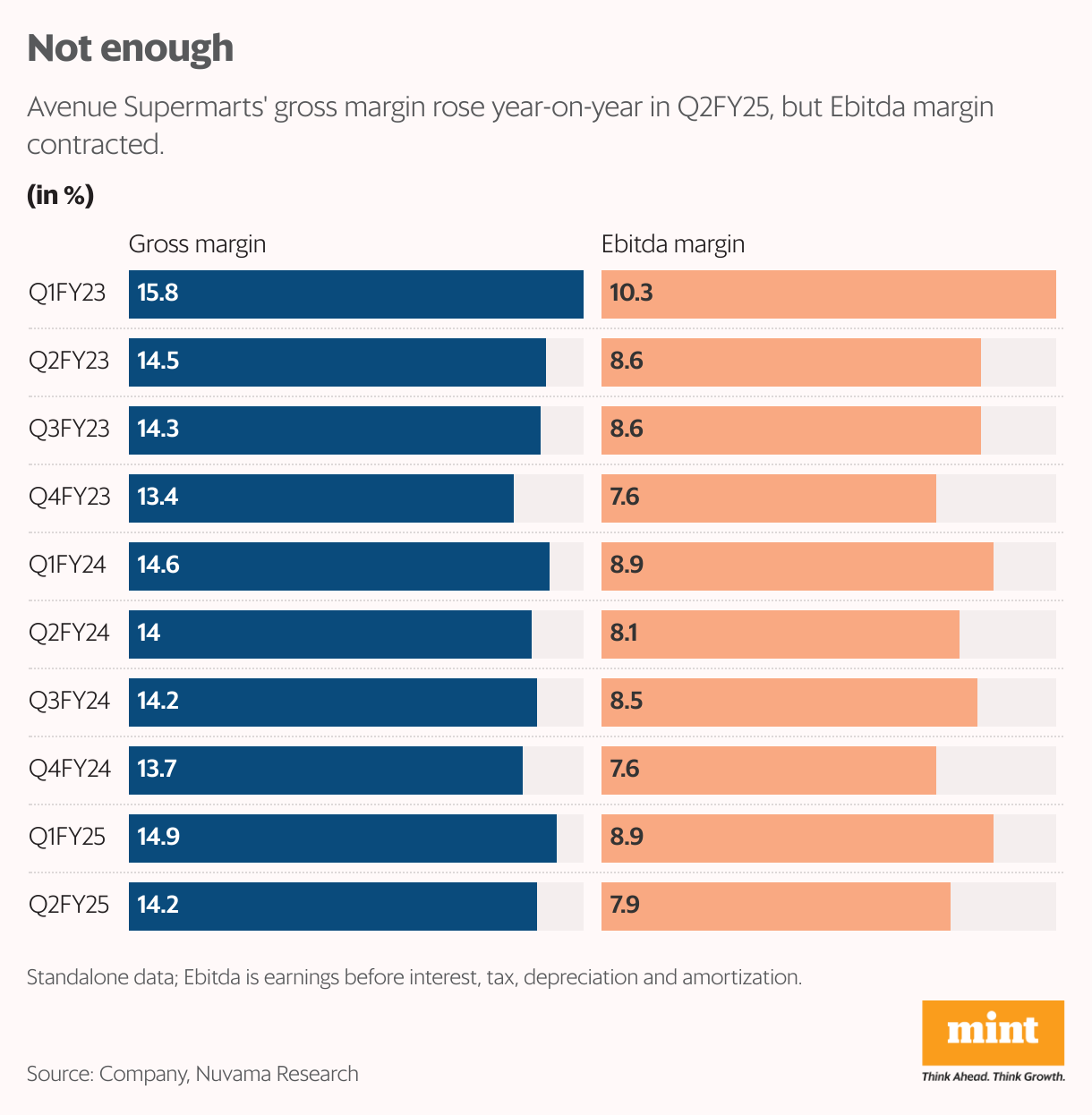

During the second quarter, Avenue’s standalone EBITDA margin decreased by 27 basis points year-on-year to 7.9%. This figure not only lagged behind analysts’ forecasts but was also notable given that the company’s gross margin managed to increase by 21 basis points to 14.2%. This increase in gross margin was attributed to a slight rise in revenue share from the high-margin segments of general merchandise and apparel. However, a sharp rise in staff costs and other operational expenses adversely affected the EBITDA margin, resulting in a relatively moderate EBITDA growth of 10%, amounting to ₹1,105 crore.

The slowdown in revenue growth is another concerning signal for Avenue. For the first half of FY25, stores that have been open for two years or more exhibited a like-for-like revenue growth of 7.4%. However, this figure dropped to 5.5% in Q2FY25. The company has acknowledged that online grocery formats, including its own DMart Ready service, have started to influence sales, especially in large metropolitan areas. These online formats often operate with much higher turnover per square foot, presenting a formidable challenge to traditional retail.

Analysts from IIFL Securities express caution, predicting that the impact of online grocery services could gradually extend to additional stores as convenience shopping habits grow among consumers. They speculate that the competitive landscape may lead to increased discounting from quick commerce companies, further squeezing margins for traditional retailers like Avenue. “We believe that a new equilibrium would be set within the next about 12 months; downgrade risks persist until then,” said IIFL analysts in a recent report.

While DMart Ready has shown a commendable growth rate of 22% in the first half of FY25, this growth is viewed as underwhelming when pitted against the rapid expansion of quick commerce companies. In response to these market dynamics, brokerage firm Jefferies India has revised Avenue’s earnings per share estimates for FY25-27 downwards by 5-6%.

To counteract declining sales growth, Avenue has been focusing on expanding its physical footprint. Similar to the previous year, the company opened 12 new stores in the first half, with expectations of a higher rate of store openings in the latter half of the fiscal year.

Currently, Avenue’s stock trades at nearly 70 times the estimated earnings for FY26, according to Bloomberg data, indicating that the company’s valuations remain high despite a significant drop of approximately 24% from its 52-week peak of ₹5,484.85, reached on September 24. As the market evolves, investors are keenly observing the competitive pressures posed by quick commerce businesses and the rate at which Avenue expands its store network.