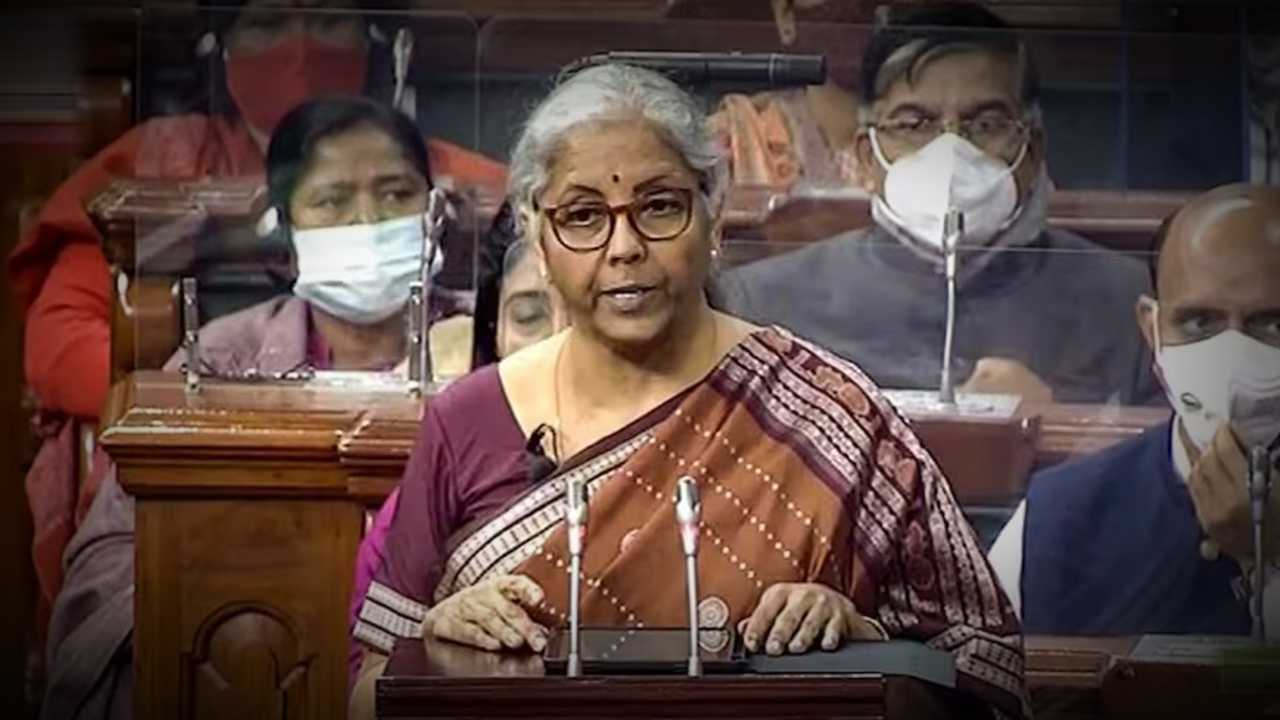

India’s Union Budget for 2025-26 is going to be announced on 1st February. Finance Minister Nirmala Sitharaman is preparing for the budget presentation. This year everyone is hoping for some big announcement that can benefit middle-class people. Rising inflation and unemployment rate with slow GDP growth is making people more worried.

Expectations from Budget 2025

As the budget announcement date comes closer common man’s hope for tax relief, and employment is getting high. What can we expect from the budget 2025-26? Let’s take a look at the key expectations:

Tax Relief for Middle Class: Experts suggest that the government should give a tax cut to individuals earning up to Rs15 Lakh annually. Also, the current rate of income tax varies from 5% to 30% according to an individual’s income. There is a Rs 50,000 limit for exemption, if this limit is increased it will give a big relief to middle-class taxpayers.

Standard Deductions: Current standard deductions for the old tax regime is capped at Rs 50,000. In the budget meeting, it was suggested to double this limit. Which will allow individuals to get Rs 1 lakh in deductions. This will give some more disposable income to every tax payer.

Employment Initiative: The unemployment rate in the country is rising. Not all states have a poor employment rate but in some states, conditions are very poor. The government should focus more on creating jobs. Schemes like PM Internship will be beneficial to youths.

Senior Citizen: Experts suggest implementing special tax slabs for senior and super senior citizens. Because they face more challenges due to the rising cost of daily expenses and evening other things.

Relief in Housing Loans: Currently if anyone takes a home loan he can make deductions up to Rs 1.5 lakh via Section 80C of the Income Tax Act. But Demands are coming to increase this deduction to Rs 3.5 Lakh.

Finally, these are all the expectations people are hoping for in budget 2025-26. But nothing can be said right now. Once the Budget comes on 1st February everything will be revealed.