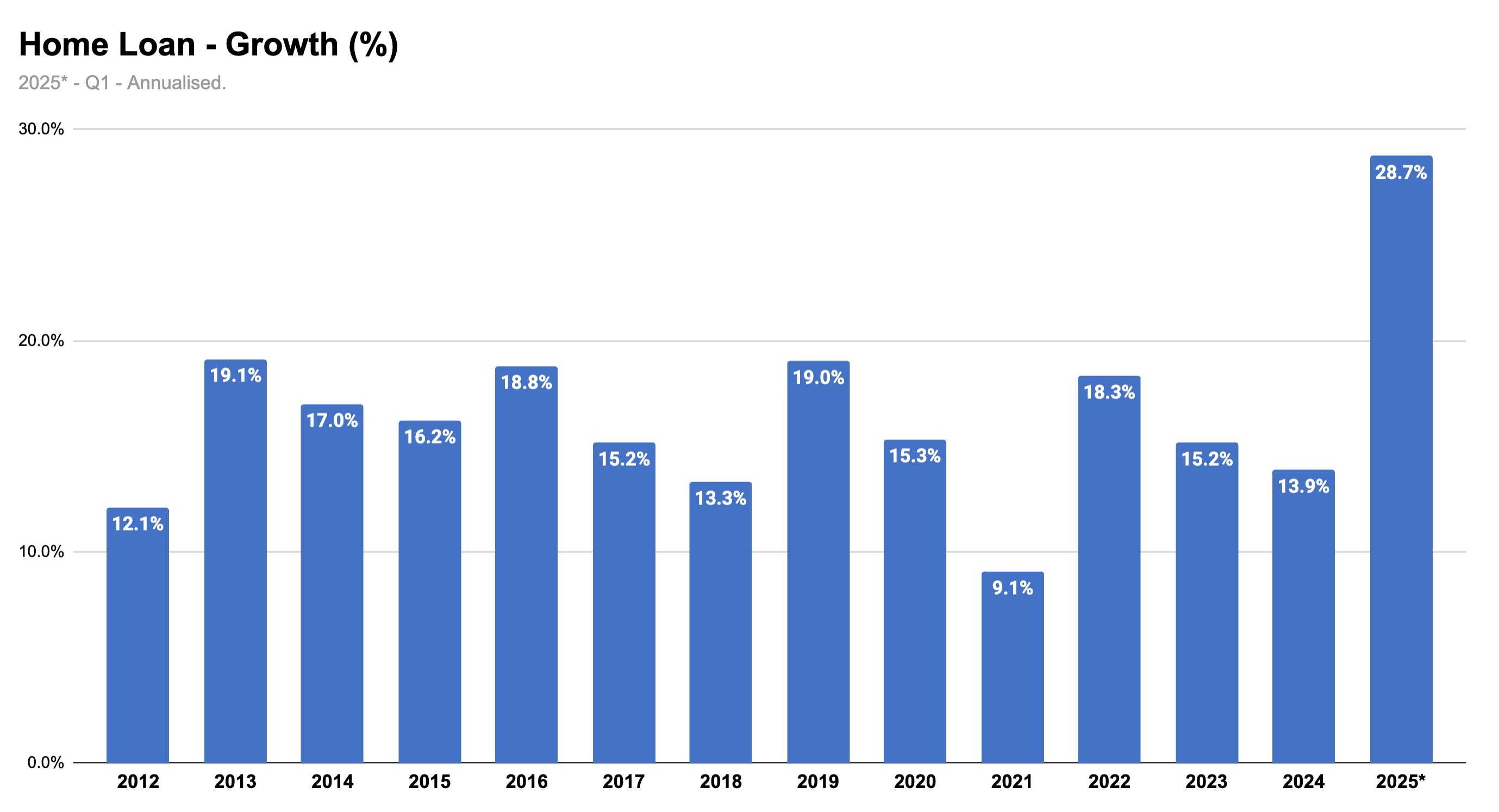

The housing finance sector is currently experiencing significant growth, evidenced by a quarter-on-quarter (QoQ) increase of 7.9%, translating to an impressive annualized growth rate of 28.7% in home loans outstanding. As interest rates are anticipated to decline further, this growth trajectory is expected to accelerate, making it a prime opportunity for both investors and homebuyers.

View Full Image

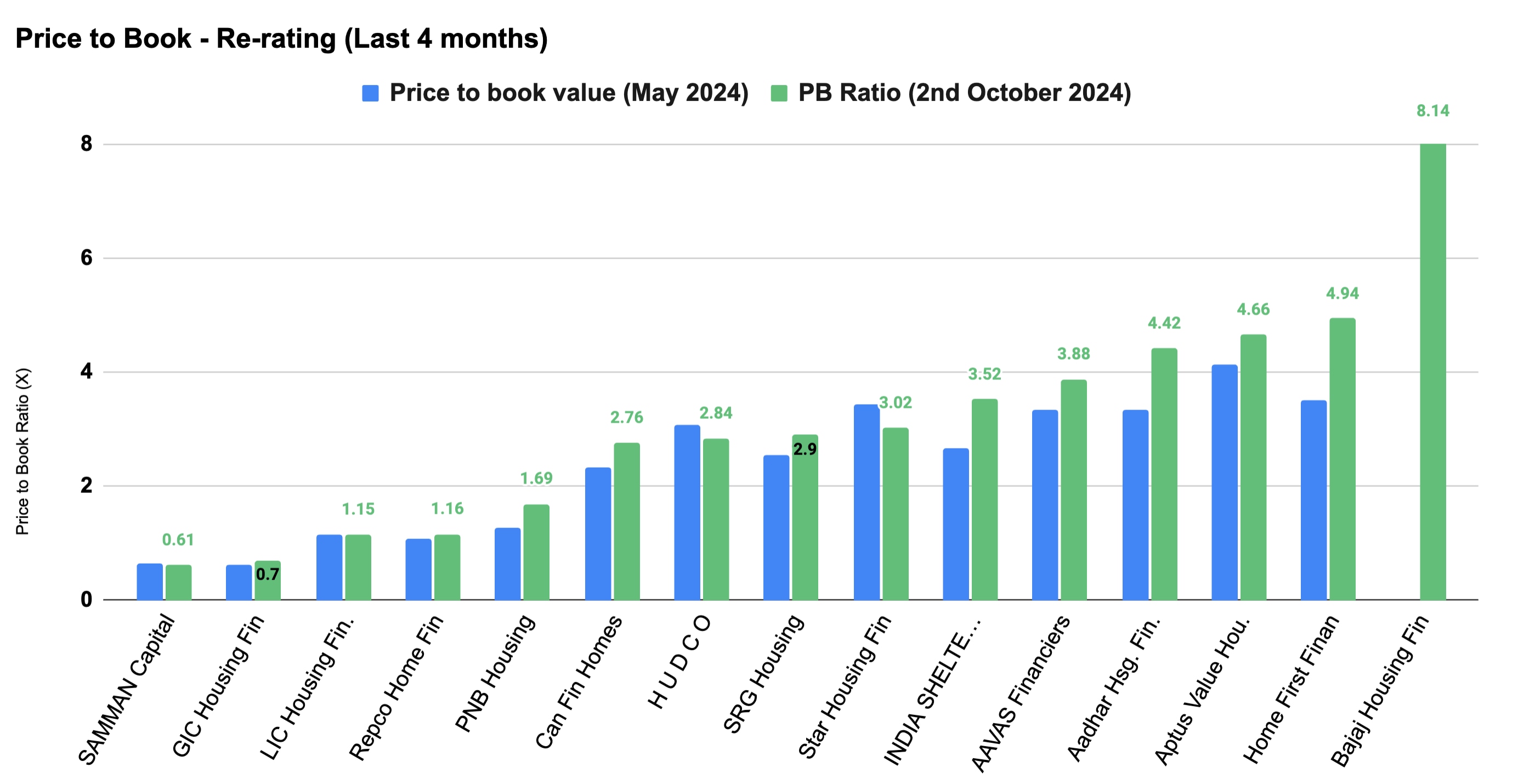

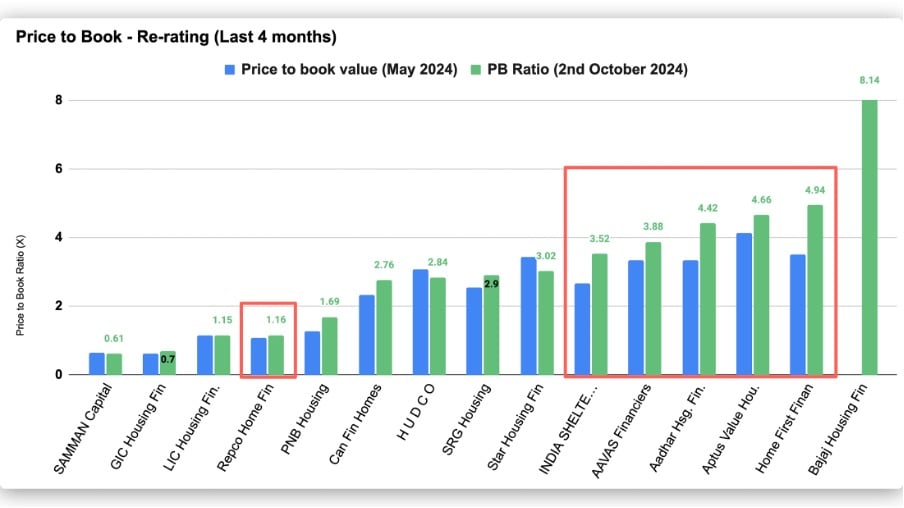

The positive trends in home loans have resulted in a notable re-rating of price-to-book (P/B) ratios across the sector. Among the 15 largest listed housing finance companies, 13 have seen their P/B ratios increase, signaling heightened market confidence in the growth prospects of the housing finance industry.

View Full Image

Despite the optimism, there are evident disparities among housing finance companies (HFCs) when compared to banks and non-banking financial companies (NBFCs). These differences arise from various competitive factors such as loan sizes (below ₹25 lakh, ₹25-50 lakh, and above ₹50 lakh), funding costs, and risk assessment capabilities. While banks often benefit from lower funding costs, they may lack efficiency in servicing some segments, especially in the affordable housing sector.

Affordable Housing Metrics

Utilizing the National Housing Bank (NHB) definition, which classifies housing loans below ₹25 lakh as affordable, Aavas Financiers is a prominent leader in this sector, despite some recent challenges. The company has struggled over the past two years, but signs indicate that the worst is now behind it, paving the way for potential recovery.

Key Metrics for Evaluation

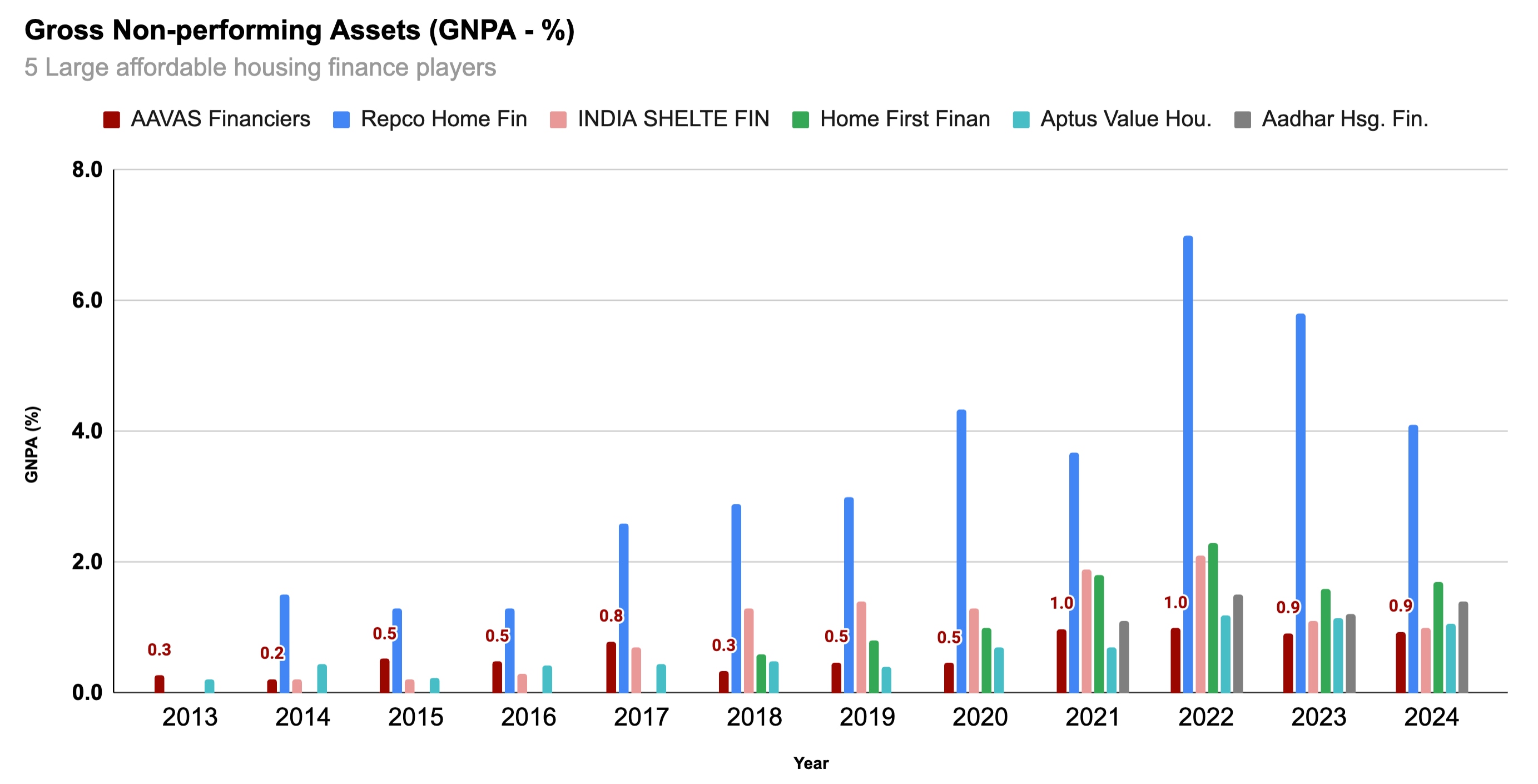

Gross Non-Performing Assets (GNPA %)

GNPA is a critical metric indicating loans overdue for more than 90 days. In the housing finance landscape, actual losses tend to be low due to the security provided by property backing the loans. However, high GNPA can stifle growth by adversely affecting an HFC’s credit rating, which in turn limits borrowing capacity and diminishes competitiveness.

View Full Image

Although the GNPA challenge is less pronounced in housing finance compared to microfinance, where unsecured loans can lead to severe problems, it still remains a concern. Notably, Aavas Financiers has managed to maintain superior asset quality compared to its peers across different market cycles.

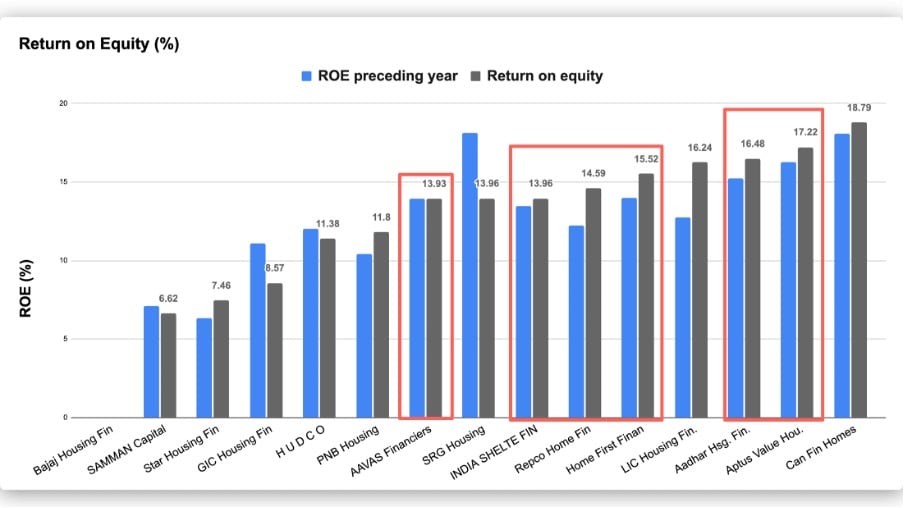

Return on Equity (ROE %)

Return on Equity (ROE) is a vital barometer of profitability, with 15% generally deemed healthy. Within the six major players in affordable housing finance, Aavas Financiers exhibits the lowest ROE for FY24, likely attributed to its lower yield rates compared to competitors such as Aptus Value Housing and Home First. Additionally, Aavas faces challenges related to the highest operating expenditure as a percentage of total assets among its peers, coupled with sluggish profit after tax (PAT) growth.

View Full Image

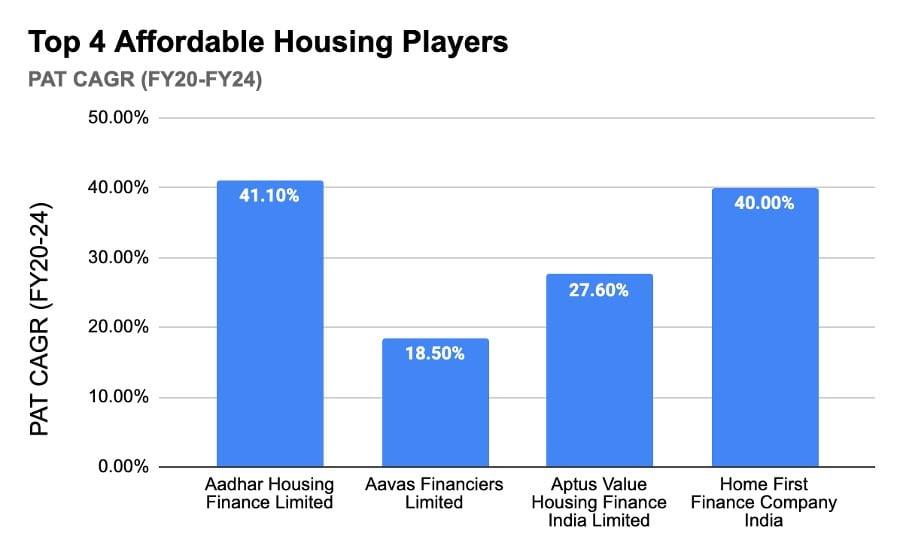

Profit After Tax (PAT) Growth (FY20-24)

PAT growth has not kept pace with competitors for Aavas Financiers over the past four years. The leadership transition from Kedaara Capital to CVC Capital may have influenced this underperformance, resulting in uncertainty regarding future asset quality under the new leadership of CEO Sachin Bhinder.

View Full Image

Price-to-Book (P/B) Ratio

Over the last four months, the P/B ratios for all affordable housing finance companies have increased sharply. Aavas Financiers, currently valued at 3.88x, ranks fourth among its competitors. While this ranking may suggest relative stability, it reflects broader concerns with management changes, modest PAT growth, and lower ROE figures.

View Full Image

Despite these challenges, there are signs of operational improvements with the operating expense to assets ratio decreasing from 3.68% to 3.27% between FY23 and Q1FY25. Additionally, sector-wide support initiatives, such as the ₹10 lakh crore central assistance in the PMAY budget and potential upcoming rate cuts, will likely bolster both the sector and Aavas Financiers in the future. The precise impact of these changes remains to be seen, yet optimism is present.

The insights shared in this article draw upon various data sources, with a focus on providing readers with pertinent charts, data points, and analytical perspectives. It is essential to note that this information is intended for educational purposes only. Interested investors should consult with a financial advisor before making any investment decisions.

As a note, I am an experienced investor with a progressive approach toward market opportunities. My analysis relies on data-driven insights rather than popular narratives, ensuring a clearer view of market movements and potential investment strategies.

Disclosure: The writer holds stocks mentioned in this article.